Macro test 2 Review

An increase in the interest rate should

Decrease consumption spending.

Increase government spending.

increase investment spending.

increase net exports.

The statement, "My iPhone is worth $700" represents money's function as

a unit of account.

A medium of exchange.

a standard of deferred payment.

A store of value

A decrease in consumer confidence can put your job at risk if

aggregate expenditures rise.

aggregate expenditures fall.

consumers expect their incomes to rise in the future.

Consumers expect firms to increase investment in the future.

If the marginal propensity to save is 0.35, the multiplier is 2.86.

True

False

During the turmoil in the market for subprime mortgages in 2007 and 2008, the Fed increased the volume of discount loans. The goal of the Fed was to

reduce the rate of inflation.

reduce unemployment.

reasssure financial markets and promote financial stability.

Stimulate economic growth.

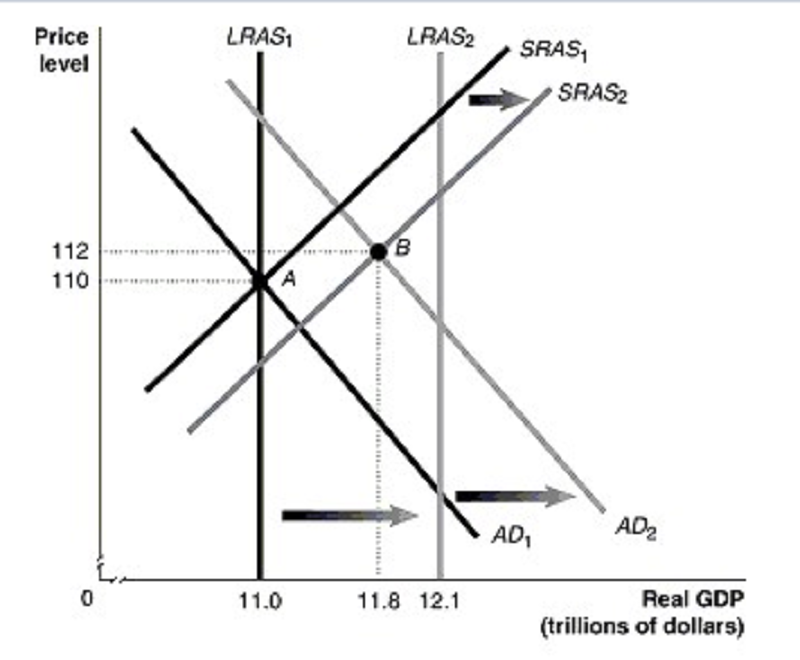

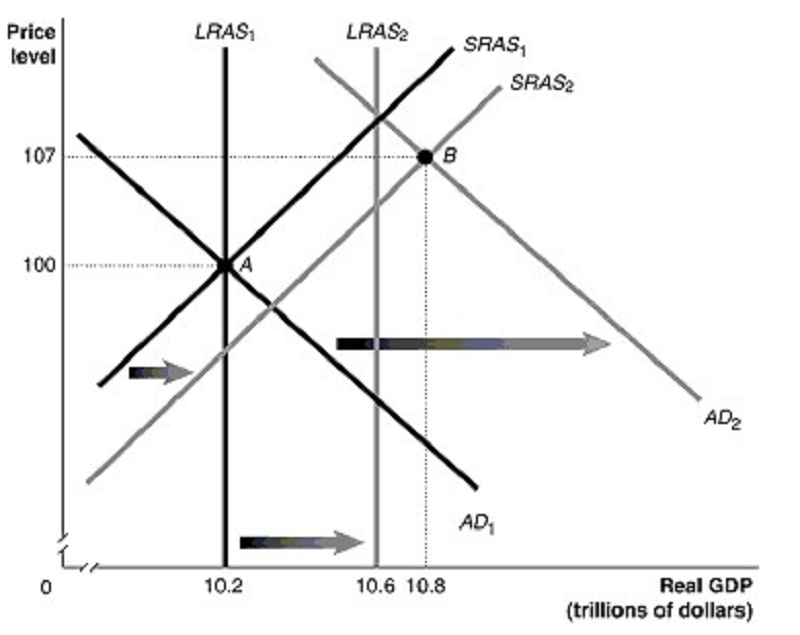

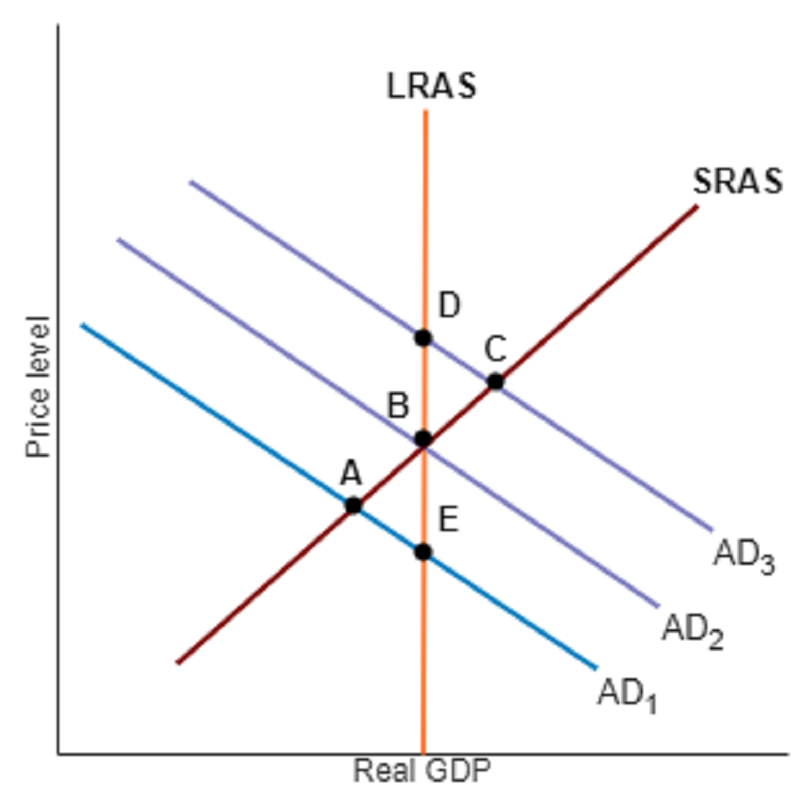

In the figure to the right, AD1, LRAS1 and SRAS1 denote AD, LRAS and SRAS in year 1, while AD2, LRAS2 and SRAS2 denote AD, LRAS and SRAS in year 2. Given the economy is at point A in year 1, what is the actual growth rate in GDP in year 2?

2.5%

7.3%

8.0%

10.0%

Refer to the diagram to the right. When the money supply shifts from MS1 to MS2, at the interest rate of 3 percent households and firms will

sell Treasury bills.

buy Treasury bills.

neither buy nor sell Treasury bills.

want to hold more money.

As a fraction of GDP, federal government purchases of goods and services

Have remained roughly the same since the early 1950s.

have fallen since the early 1950s.

have risen since the early 1950s.

rose from the early 1950s until the mid1980s, and then fell.

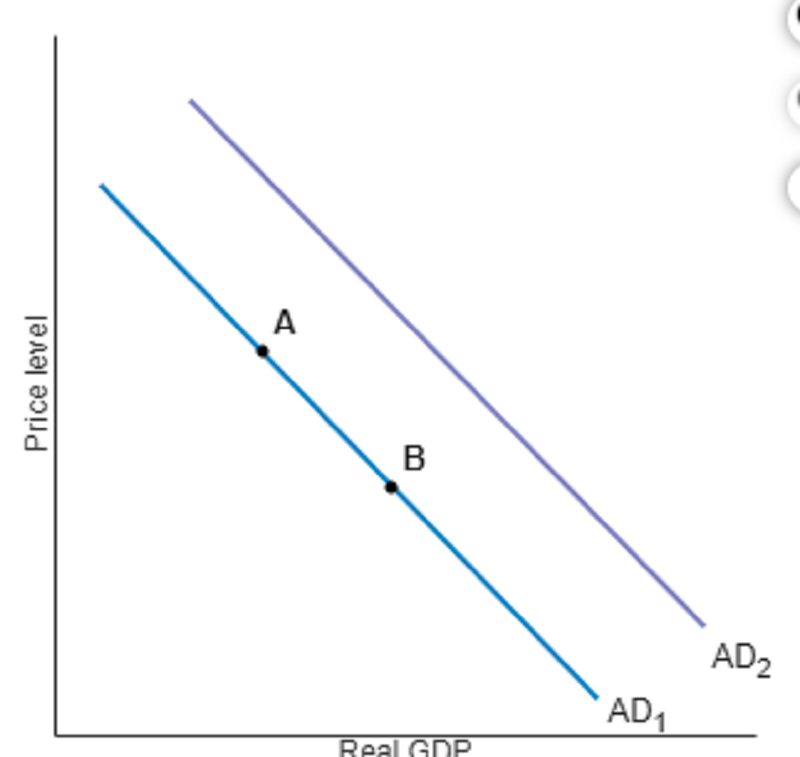

Refer to the figure to the right. Ceteris paribus, an increase in the price level would be represented by a movement from Part 2

AD1 to AD2.

AD2 to AD1.

point A to point B.

Point B to point A.

Which of the following best describes supply-side economics?

Tax rates affect the incentive to work, save, and invest, and therefore aggregate supply.

Education impacts the incentive to work, save, and invest, and therefore aggregate supply

Labor productivity impacts aggregate supply.

Education impacts labor productivity which impacts aggregate supply.

Question content area Part 1 Assume a closed economy with fixed taxes and the marginal propensity to consume is equal to 0.9. What is the government spending multiplier?

10

9

5

1

Bank reserves include

Vault cash and loans to bank customers.

loans to bank customers and deposits with the Federal Reserve.

vault cash and deposits with the Federal Reserve.

customer checking accounts and vault cash.

Interest rates in the economy have fallen. How will this affect aggregate demand and equilibrium in the short run?

Aggregate demand will rise, the equilibrium price level will rise, and the equilibrium level of GDP will rise.

Aggregate demand will rise, the equilibrium price level will fall, and the equilibrium level of GDP will rise.

Aggregate demand will fall, the equilibrium price level will rise, and the equilibrium level of GDP will fall.

Aggregate demand will fall, the equilibrium price level will fall, and the equilibrium level of GDP will fall.

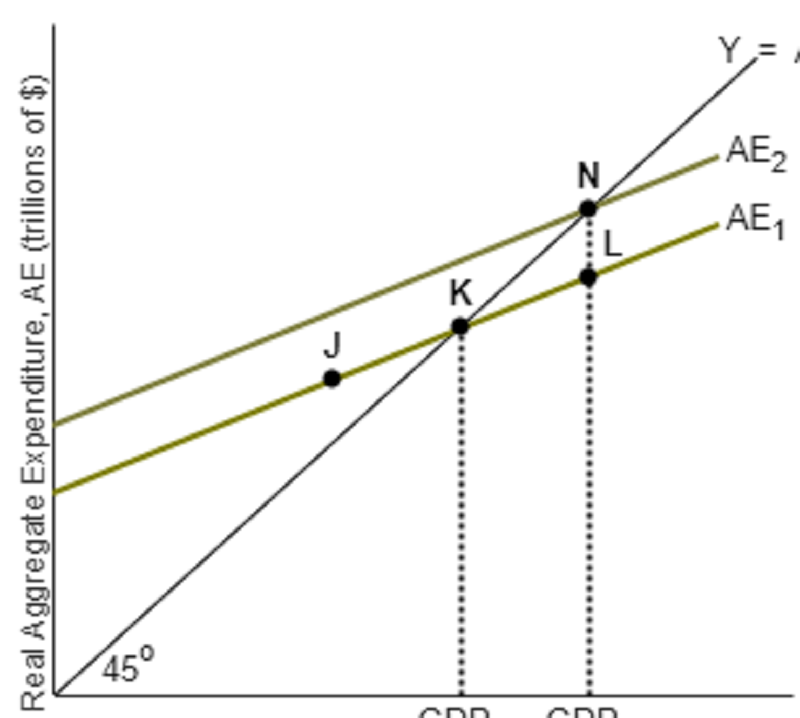

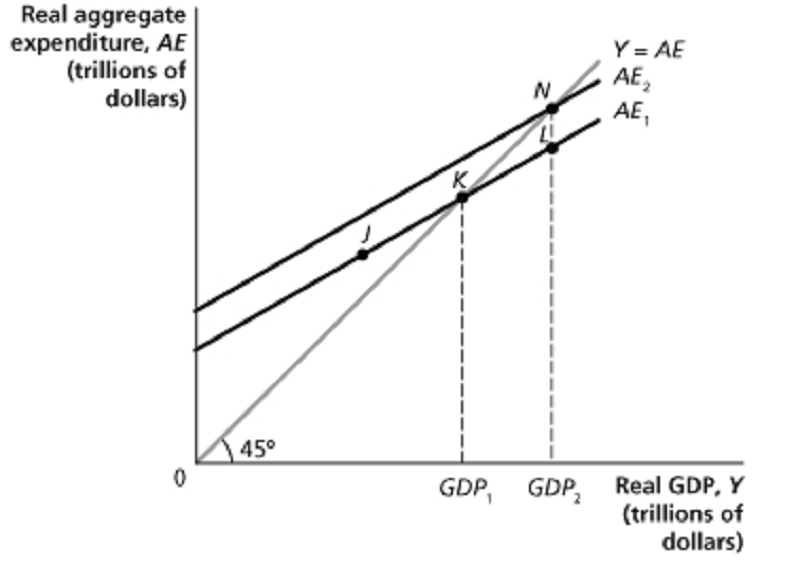

Refer to the diagram to the right. Suppose that investment spending increases by $10 million, shifting up the aggregate expenditure line and GDP increases from GDP1 to GDP2 . If the MPC is 0.9, then what is the change in GDP?

$90 million.

9 million.

$10 million.

$100 million.

The quantity theory of money was derived from the quantity equation by asserting that Part 2

the money supply was fixed

The velocity of money was zero.

The velocity of money was fixed.

Real output was fixed.

The aggregate demand curve shows the relationship between the price level and the level of planned aggregate expenditure in the economy.

True

False

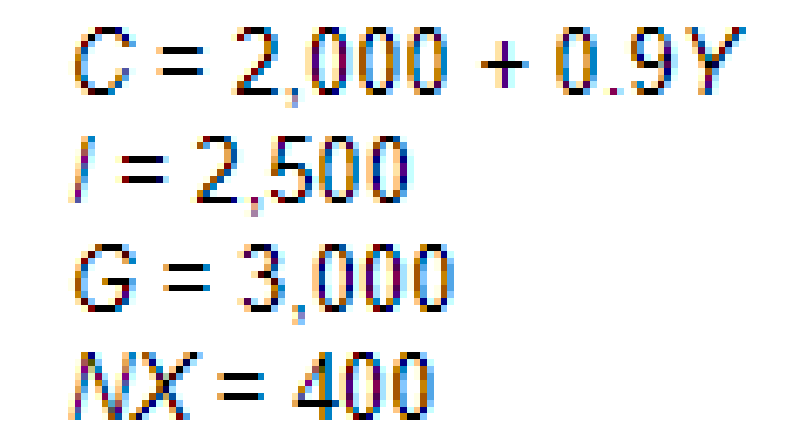

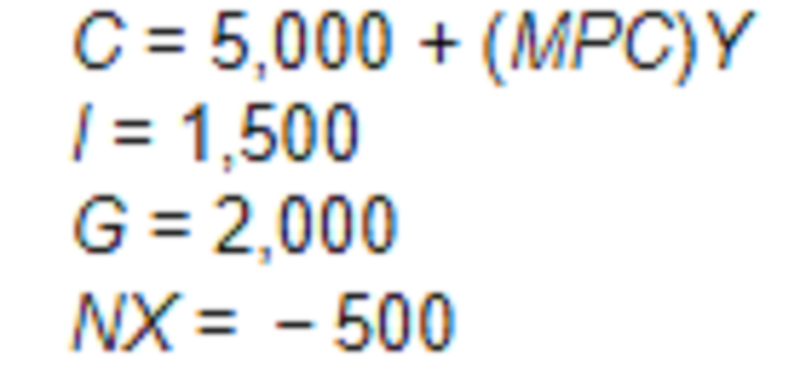

Given the equations for C, I, G, and NX below, what is the equilibrium level of GDP?

�$4,333

$7,100

$8,778

$79,000

Which of the following leads to a decrease in real GDP?

An increase in government spending

An increase in the inflation rate in other countries, relative to the inflation in the United States

an increase in interest rates

Households have increasingly optimistic expectations about future income.

Which of the following would cause the short-run aggregate supply curve to shift to the left?

an increase in the price level

A technological advance

an increase in inflation expectations

a decrease in interest rates

Given that the economy has moved from point A to point B in the graph to the right, which of the following would be the appropriate fiscal policy to achieve potential GDP?

increase government spending

increase taxes

decrease the money supply

increase interest rates

If disposable income falls by $50 billion and consumption falls by $40 billion, then the slope of the consumption function is

1.20

0.80

0.70

0.10

The multiplier effect refers to the series of

autonomous increases in consumption spending that result from an initial increase in induced expenditures.

Autonomous increases in investment spending that result from an initial increase in induced expenditures.

induced increases in investment spending that result from an initial increase in autonomous expenditures.

induced increases in consumption spending that result from an initial increase in autonomous expenditures.

Which of the following is an example of discretionary fiscal policy?

a decrease in food stamps issued during an expansion or boom

An increase in income tax receipts with rising income during an expansion

An increase in unemployment insurance payments during a recession

the tax cuts passed by Congress in 2001 to combat the recession

Planned aggregate expenditure is equal to

Consumption spending only.

consumption spending plus planned investment spending plus government purchases plus net exports.

Planned investment spending only.

Consumption spending plus planned investment spending.

The larger the MPS, the smaller the value of the multiplier.

True

False

To evaluate the size of the federal budget deficit or surplus over time, it would be best to look at the

Absolute size of the budget deficit or surplus.

Budget deficit or surplus as a percentage of tax revenues.

Budget deficit or surplus as a percentage of government spending.

Budget deficit or surplus as a percentage of GDP.

A person's wealth

equals the value of the person's assets minus his or her liabilities.

is a measure of only his or her current and expected future income.

is a measure of how much money the person has.

All of the above are correct

Equations for C, I, G, and NX are given below. If the equilibrium level of GDP is $32,000, what will the new equilibrium level of GDP be if government spending increases to 2,500?

$32,500

$34,000

$38,000

$42,000

Suppose the president is successful in passing a $5 billion tax increase. Assume that taxes are fixed, the economy is closed, and the marginal propensity to consume is 0.75. What happens to equilibrium GDP?

There is a $15 billion decrease in equilibrium GDP.

There is a $20 billion decrease in equilibrium GDP.

There is a $20 billion increase in equilibrium GDP.

There is a $15 billion increase in equilibrium GDP.

Suppose that investment spending decreases by $5 million, decreasing aggregate expenditure and decreasing real GDP from GDP2 to GDP1. If the MPC is 0.8, then what is the change in GDP?

- $4 million

- $5 million

-$25 million

-$40 million

The Fed can attempt to increase the federal funds rate by

Buying Treasury bills, which increases bank reserves.

buying Treasury bills, which decreases bank reserves.

selling Treasury bills, which increases bank reserves.

Selling Treasury bills, which decreases bank reserves

Consumption spending refers to ________ spending on goods and services.

Household

Foreign

Buisiness

Governemnt

During 2008, oil price increases

shifted the short-run aggregate supply curve farther to the left than similar increases had 30 years earlier

Shifted the aggregate demand curve farther to the left than similar increases had 30 years earlier.

did not shift the short-run aggregate supply curve as far to the left as similar increases had 30 years earlier.

shifted the aggregate demand curve farther to the right than similar increases had 30 years earlier.

Decreases in the price level will

lower consumption because goods and services are less affordable.

Raise consumption because real wealth increases.

Raise consumption because goods and services are more affordable.

lower consumption because real wealth decreases.

Question content area top Part 1 The main goal of monetary policy for recent Fed Chairmen has been to maintain high employment in labor markets.

True

False

Question content area Part 1 A decrease in investment causes the price level to ________ in the short run and ________ in the long run. Part 2

Decrease; decrease further

increase; increase further

Decrease; increase

Increase; decrease

Question content area top Part 1 According to the quantity theory of money, if the money supply grows at 6%, real GDP grows at 2%, and the velocity of money is constant, then the inflation rate will be

8%.

6%.

4%.

2%.

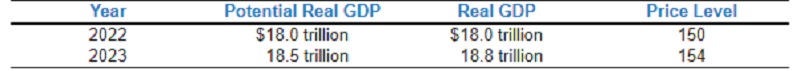

Consider the hypothetical information in the table for potential real GDP, real GDP, and the price level in 2022 and in 2023 if the Federal Reserve does not use monetary policy. If the Fed wants to keep real GDP at its potential level in 2023, it should

Decrease income taxes

sell Treasury securities.

Decrease the required reserve ratio.

Buy Treasury securities.

When the economy enters a recession, your employer is ___________ to reduce your wages because _______

likely; aggregate demand is vertical in the long run

Unlikely; output and input prices generally fall during recession

Likely; output prices always fall during recession

Unlikely; lower wages reduce productivity and morale

Which of the following about fiat money is false? Fiat money

Has little to no value except as money.

Serves as a medium of exchange.

is backed by gold.

Is authorized by a central bank or governmental body.

A general formula for the multiplier is

1/MPS

1/MPC

1/MPC-1

1/1-MPS

If the consumption function is defined as C = 7,250 + 0.8Y, what is the value of the multiplier?

0.2

0.8

1.25

5

Suppose the government spending multiplier is 2. The federal government cuts spending by $40 billion. What is the change in GDP if the price level is not held constant? Part 2

A decrease of less than $80 billion

an increase of greater than $80 billion

An increase of less than $80 billion

a decrease of more than $80 billion

Using the money demand and money supply model, an open market sale of Treasury securities by the Federal Reserve would cause the equilibrium interest rate to

decrease.

increase, then decrease.

increase.

Not change.

Which of the following are goals of monetary policy?

Maximizing the value of the dollar relative to other currencies, economic growth, and high employment

price stability, maximizing the value of the dollar relative to other currencies, and high employment

price stability, economic growth, and high employment

Price stability, economic growth, and maximizing the value of the dollar relative to other currencies

Refer to the figure. Suppose the economy is in short-run equilibrium below potential GDP and no fiscal or monetary policy is pursued. Using the basic AD-AS model in the figure, this would be depicted as a movement from

A to E

A to B.

B to C.

C to B.

The aggregate demand curve illustrates the relationship between ________ and the ________, holding constant all other factors that affect aggregate expenditure.

the price level; quantity of planned investment expenditure

the inflation rate; quantity of planned aggregate expenditure

the price level; quantity of planned aggregate expenditure

The price level; quantity of consumption expenditure

Which of the following is not an assumption made by the dynamic model of aggregate demand and aggregate supply?

Aggregate demand shifts to the right during most periods.

Potential real GDP increases continuously.

Short run aggregate supply shifts to the right except during periods when workers and firms expect higher wages.

Aggregate demand and potential real GDP decrease continuously.

Disposable income is defined as

national income + transfers + taxes.

National income transfers + taxes.

national income + transfers taxes.

National income transfers taxes.

Refer to the table above. Consider the following simplified balance sheet for a bank. If the required reserve ratio is 10 percent, the bank can make a maximum loan of

$45,000

$5,000

$6,300.

$2,000.

The velocity of money is defined as

M/ P x Y

the average number of times each dollar is used to purchase goods and services.

the total number of times each dollar is used to purchase goods and services.

P x Y.

Ceteris paribus, an increase in government spending would be represented by a movement from

AD1 to AD2.

AD2 to AD1.

Point A to point B.

point B to point A.

Consider a tax cut which affects not only consumer disposable income, but also aftertax earnings from labor supplied to labor markets and from financial assets acquired through saving. In the long run we would expect this tax cut to

decrease the price level and increase the level of real GDP.

Decrease the level of real GDP

increase both the price level and the level of real GDP.

Decrease the price level.

If planned aggregate expenditure is less than total production,

GDP will decrease.

Actual inventories will equal planned inventories.

firms will experience an unplanned decrease in inventories.

the economy is in equilibrium.

Spending on the war in Afghanistan is essentially categorized as government purchases. How do increases in spending on the war in Afghanistan affect the aggregate demand curve?

They will move the economy down along a stationary aggregate demand curve.

They will shift the aggregate demand curve to the left.

They will shift the aggregate demand curve to the right.

They will move the economy up along a stationary aggregate demand curve.

If a person withdraws $500 from his/her checking account and holds it as currency, then M1 will ________ and M2 will ________

Not change; increase

Decrease; increase

not change; not change

Increase; decrease

Suppose the president is successful in passing a $10 billion tax increase. Assume that taxes are fixed, the economy is closed, and the marginal propensity to consume is 0.8. What happens to equilibrium GDP? Part 2

There is a $40 billion decrease in equilibrium GDP.

There is a $50 billion increase in equilibrium GDP.

There is a $40 billion increase in equilibrium GDP.

There is a $50 billion decrease in equilibrium GDP.

The tax multiplier

is negative.

Is larger in absolute value as compared to the government spending multiplier.

Is a measure of how much taxes will fall when income is falling.

is always less than one.

Question content area Part 1 Argentine banks were hampered by the government's decision to tie the peso to the U.S. Dollar at a rate of one to one. This policy of fixing the peso to the dollar

Caused the Argentine public to lose faith in the ability of the Argentine currency to retain its value.D

prevented the central bank from acting as the lender of last resort during a banking panic.

Encouraged faith in the banking system and resulted in the public depositing large sums into Argentine banks.

Caused inflation in the Argentine economy to greatly increase and subsequently decrease the purchasing power of the currency.

An increase in the price level in the United States will have what effect on the aggregate expenditure line?

Aggregate expenditure will shift upward.

Aggregate expenditure will become steeper.

Aggregate expenditure will shift downward.

Aggregate expenditure will not be affected by an increase in the price level in the United States.

________ of unemployment during ________ make it easier for workers to ________ wages.

A. Low levels; a recession; accept lower

High levels; an expansion; accept lower

High levels; a recession; negotiate higher

Low levels; an expansion; negotiate higher

Which of the following could explain why there is an increase in potential GDP but the equilibrium level of GDP falls?

AD did not shift and SRAS shifted to the left.

AD shifted to the right by more than SRAS.

AD shifted to the right by less than SRAS.

SRAS shifted to the right by more than LRAS.

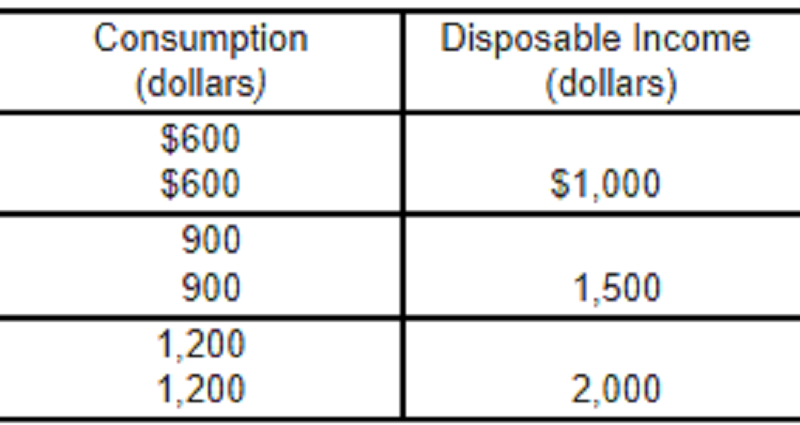

Given the data in the table, the marginal propensity to consume is

0.5

0.6

0.75

0.8

Consumption is $5 million, planned investment spending is $8 million, government purchases are $10 million, and net exports are equal to $2 million. If GDP during that same time period is equal to $23 million, what unplanned changes in inventories occurred?

There was an unplanned decrease in inventories equal to $2 million.

There was an unplanned decrease in inventories equal to $19 million.

There was an unplanned increase in inventories equal to $2 million.

There was no unplanned change in inventories.

Which of the following leads to a decrease in real GDP?

an increase in government spending

an increase in the inflation rate in other countries, relative to the inflation in the United States

An increase in interest rates Your answer is correct.

Households have increasingly optimistic expectations about future income.

{"name":"Macro test 2 Review", "url":"https://www.quiz-maker.com/QPREVIEW","txt":"An increase in the interest rate should, The statement, \"My iPhone is worth $700\" represents money's function as, A decrease in consumer confidence can put your job at risk if","img":"https://www.quiz-maker.com/3012/CDN/94-4622361/screenshot-2023-10-30-130606.png?sz=1200-00000000000986308253"}

More Quizzes

Which bird are you

4232

What hyperfixation would u like

13618

Skincare

5218

Quiz Cerdas Cermat Alkitab AT tahap 2

221133

Canadian Aviation Regulations Practice Test 4 of 6 - Free

201017898

Dingbats Online - Free Puzzle to Solve Now

201019139

Which Caribbean Island Should You Visit? Free

201017102

Who Is My Divine Protector? Free Olympian Parent

201017292

90s Hip Hop Trivia - Free Questions & Answers

201022125

Pregnant or Menopause - Free Symptom Checker

201017621

What Your Favorite Holiday Says About You -

201016623

What Lana Del Rey Song Am I? - Free Online

201018807