Exam Prulife

Prulife Knowledge Assessment

Test your knowledge on life insurance with our comprehensive quiz designed for both beginners and professionals. With 105 carefully crafted questions, this quiz will challenge your understanding of life insurance concepts and policies.

Discover if you have what it takes to grasp essential life insurance principles and enhance your expertise.

- Multiple-choice questions

- Instant feedback on your answers

- Learn about life insurance policies, riders, and provisions

Both endowment and term life policies provide that

No cash value is available to the policy owner during the term of the policy

Renewal and conversion privileges are available

A benefit will be paid at the end of the period of coverage if the person is the alive

Insurance protection will be limited to a specified period

Indicate which of the following is not a function of an application for life insurance policy.

To give details pertaining to non-forfeiture options

To function on which the contract of life insurance may be written

To furnish initial information as to insurability

To convey to the company the desire of the applicant to obtain insurance

A father has his present life insurance payable to his estate and because he has now retired he wants to pass the policy on to his son who will assume the premium payments. Which of the following will he have to appoint his son to achieve his desire and protect the son from Estate Tax Liability?

Irrevocable primary beneficiary

Absolute assignee

Irrevocable secondary beneficiary

Revocable primary beneficiary

A policy where an irrevocable beneficiary has been designated the insured, without the beneficiary’s permission, can

Avail of a non-forfeiture option

Discontinue premium payments

Borrow minimal cash loan

After the dividend option now in effect

What are the basic settlement options?

Policy loan, guaranteed insurability

Cash surrender value, automatic premium loan

Fixed amount, fixed period, life income, interest on deposit

Double indemnity, total and permanent disability waiver

An insurance company generally has the right to rescind a life insurance policy

Company discovers at any time that the policy owner was actually a minor at the time of application

Insured person intentionally kills himself during the suicide exclusion period specified in the policy

Insured person is killed in military action during the contestable period of the policy

Company discovers during the contestable period that the application contains a material statement

Which of the following is the least important reason for requiring that insurance agents be licensed?

To establish and maintain high professional and ethical standards

To protect the public

To give the government adequate control over the conduct of agents

To provide additional income to the government through license fees

In the event that a policy owner elects the paid-up insurance option

The premiums stop and the policy continues for the full face amount until age 65

The insurance continues at a reduced amount and with a reduced premium

The policy will automatically terminate

The premiums cease and protection continues with a reduced amount of Coverage

The company will allow a policy change from a higher premium to a lower premium provided the insured

Buys a new plan altogether

Presents satisfactory evidence of insurability

Momentarily assigns the policy to the company

Obtains written consent from his or her spouse

A policy which permits the policyholder to vary the level of premiums, the sum insured and has its cash values dependent upon the investment performance and the level of premium paid is known as ___________ policy

Participating whole life policy

Participating endowment

Universal life

None of the above

Which of the following statements about “Disability Waiver of Premium Rider” is false?

Disability must occur before a stated date

The insured has to die while disabled

There is a waiting period

It has to be attached to a life insurance policy

In most life insurance applications, the largest amount of information requested is data which

Identifies the applicant

Describe the type of insurance applied for

Relates to the insurability of the applicant

Describe the desired benefits and mode of payment

Paid-up additions

Affect both cash and loan value of the policy

Don’t affect the cash value of the policy

Don’t affect the loan or cash value of the policy

Only affect the cash value of the policy

The total life coverage of a permanent basic policy can be greatly increased through the use of

An accidental death benefit rider

An interim term rider

A supplemental term rider

None of the above

Life insurance companies make use of the laws of profitability in order to

Estimate future death rates among members of a given group

Predict when an individual insured will die

Develop statistics of past deaths among the general population

Determine the experienced death rate among the insured person

In the case of renewable term insurance, the policy owner may

Renew the coverage based on a higher premium

Change the life insured at renewal date

Renew providing the insurance company agrees to continue coverage

Renew at the same premium for future period of years

A man applied for a Ps. 20,000 whole life policy and paid the full initial premium to the soliciting agent. The agent issued a binding receipt. Under such receipt, the insurance company

Offers permanent insurance coverage effective as of the date of the application

Promises that the insurance coverage will become effective as of the date the application is approved

Guarantees the policy will be issued as applied for

Immediately provides interim insurance that remains in effect until the policy is issued or the application is declined

Endowment life insurance and term life insurance are similar in that both plans

Build up cash value rapidly in the early policy years

Provide for payment of the face amount if the insured is alive at the end of the specified period

Provide life insurance protection for only the period of time specified in the policy contract

Contain provisions for automatic continuation of the insurance protection at the end of a specified period

An agent who determines a prospect’s complete financial requirements preparatory to offering him a policy using the correct selling approach known as

Counselor selling

Total needs selling

Planned selling

Multiple product selling

Name the provision in a permanent life insurance policy under which premiums are discontinued, full insurance will be maintained for a specified period:

Extended term insurance

Paid-up insurance additions

Life income option pension

Reduced paid-up insurance

Notwithstanding various possible legal impediments, if the owner of an endowment at age 65 policy tells you that the maturity of the policy he wants to provide his church with a monthly donation for as long as the church exists. Which option do you recommend?

Fixed income option

Periodic annuity option

Interest option

Life annuity option

The extent of medical evidence required is determined by

The age of the applicant and the proposed sum to be insured

Occupation of the applicant

Financial condition of the applicant

Date of the last medical examination

The conservation of a life insurance policy is dependent on all the following except

The level of first year commission

Agent’s service oriented attitude

Pressure selling

The use of effective needs selling

All of the following are sources of information to an insurance company pertaining to the insurability of an applicant except

The applicant’s personal appearance

Medical examination report

Agent’s inspection report

Government tax records

If the applicant for life insurance fails to disclose or misrepresents material fact, the contract is

Valid if the insurer issues a policy which is delivered to the applicant

Void from the beginning

Voidable by the insurer if it has been in force less than 2 years

Valid unless the insurer can prove fraud

The settlement options provision may provide all of the following except:

Payment of the proceeds for the life of the insured

Payment of the proceeds over a fixed period

Payments of the proceeds in fixed amounts until exhausted

Proceeds held by the company, with interest payable to the beneficiary on request

Non-forfeiture provisions are included in whole life and endowment policies to assure the policy owner that certain minimum policy benefits shall remain with him even under certain changed conditions. Non-forfeiture values guarantee to the policy owner that

No death claim will be denied for any misstatement on the application

Any guaranteed policy values will belong to the policy owner even if premium payments are discounted

Any guaranteed policy values will belong to the policy owner even if premium payments are discounted

The premium on the policy will remain the same even when another beneficiary is added to the policy

Purchasing a continuous-premium, whole life policy rather than limited payment, whole life policy gives the policy owner the advantage of

Concentration of premium payments during period of highest Earnings

Liberal risk selection procedures

More insurance protection for the same annual premiums outlay

More rapid accumulation of cash values

In certain situations a company may file inter pleader actions with a Court of Law. This remedy is used to

Determine if the cause of the insured’s death was an excluded risk

Decide conflicting claims on the same insurance proceeds

Resolve the question of insurable interest

Recommend the best settlement options for the beneficiary if the interest on a policy loan is not paid at the policy anniversary the insurance

Which of the following statement is false?

The cash value of a whole life policy builds up at a slower rate than for a 20 year endowment

The cash value in a permanent policy is guaranteed by the company

The cash value of an endowment builds up faster than that for a limited pay life policy of the same duration

Because of its very short duration the cash value of a yearly renewable term policy grows very fast

Which of the following does not have a legitimate insurable interest?

An individual on the life of his mistress

An individual on his own life

An individual on the life of his spouse

A finance company on the life of its borrower

The basic coverage provided by the life insurance policies may be supplemented by a separate provision that provides coverage for accidental amounts or of a different nature. Collectively these provisions are known as

Riders

Deposit privileges

Dividends

Assignment

Which of the following statements regarding insurance premiums is false?

Cash is required for all premiums paid in the grace period

A premium is the legal consideration needed to affectuate a life insurance policy

The grace period is usually 31 days

Premiums which are paid quarterly or semi-annually are higher than those paid annually

A non-forfeiture option would ordinarily be selected at the time a policy owner

Renews a term life policy

Converts a term policy to a whole life policy

Chooses a mode of settlement for a life proceeds

Discontinues premium payments for a whole life or endowment policy

If the interest on a policy loan is not paid at the policy anniversary the insurance company may

Demand full settlement of the loan

Terminate the contract

Refuse to grant future additional loan

Increase the present loan by the interest

The incontestability clause

Gives the company the right to rescind s policy at any time

Permits the company to pay claims within 2 years

Make it necessary for the beneficiary to present proof of death in the event of death claim

Prevents the company from denying a claim after the policy has been in force for 2 years

The insured named a primary and secondary revocable beneficiary for Ps. 20,000 policy. Which of the following are correct?

The designation of a contingent beneficiary is subject to the primary beneficiary’s approval

The insured can add a third beneficiary at any time

Any policy loan assignment will require the primary beneficiary’s signature

Upon the insured’s death the primary and secondary beneficiaries shall each receive Ps. 10,000

When you bought an insurance policy on your wife’s life, you were 27 and she was 26, but you stated that you were 26 and she was 27. Five years later your wife died. The insurer will pay

Slightly less than the face amount

The face amount

The face amount adjusted for misstatement of age

The sum of the premium paid

If the interest on a policy loan is not paid at the policy anniversary the insurance company may

Increase the present loan by the interest

Terminate the contract

Refuse to grant future additional loan

Demand full settlement of the loan

A yearly renewable term life insurance policy generally specifies that

The policy owner may renew the policy only once

Premiums shall increase every time the policy is renewed

Evidence of insurability shall be required every renewal

Cash values will increase for as long as the policy is in force

In a case where the premium has not been paid and the cash values has been exhausted, the policy can still avail of the grace period.

True

False

According to the law of large numbers, events which happen seemingly by chance will actually be bound to follow a predictable pattern, if enough such happenings are observed.

True

False

Anti-selection occurs when persons in poor health wish to buy insurance.

True

False

A policy is still in force for the full face amount and will remain in force for a further period of four years and 118 days, without the payment of any premiums has availed of paid up insurance option.

True

False

In the case of misstatement of age, the amount of insurance is adjusted to the amount which the premium paid at the correct age would have purchased.

True

False

A policy that provides guaranteed cash value plus extra annual distributions and pays the insured after a specified time is known as a participating endowment.

True

False

In a group insurance it is assumed that every member of the group is insurable, provided that every member of the group is working a minimum number of (usually 50 hours) each week.

True

False

An endowment at age 65 policy with premium payable for a limited period of 20 years pays the full amount after 20 years.

True

False

In most life insurance applications, the largest amount of information requested is data which identifies the applicant.

True

False

A policy is not rendered void by reason of misstatement of the assured’s death

True

False

Variable life insurance policy owners may make withdrawals in terms of ____________ .

Number of units or fixed monetary amount through cancellation of units.

Number of units of fixed monetary through reduction of the life cover sum assured

Fixed monetary amount only through reduction of the life cover sum assured

Number of units through cancellation of units

Which of the following statements about flexibility features of variable life policies is false?

Policyholders may request for a partial withdrawal of the policy and the withdrawal amount will be met by cashing the units at the bid price.

Policyholders can take loans against their variable life up to the entire withdrawal value of their policies

Policyholders have the flexibility of switching from one fund to another provided it satisfies the company’s switching criteria

Policyholders have the flexibility of increasing or decreasing their premiums for regular premium variable life policies

The investment returns under variable life insurance policy __________ I. Are not guaranteed II. Are assured III. Are linked to the performance to of the investment fund managed by the life insurance company IV. Fluctuate according to the rise and fall of market prices

I, II and III

I, II and IV

I, III and IV

II, III and IV

Which of the following statement is TRUE? I. The policy value of variable life policies is determined by the offer price at the time of valuation II. The policy value of endowment policies is the cash value plus any accumulated dividends less any outstanding loans due at the time of the surrender III. The life company needs to maintain a separate account for variable life policies distinct from the general account

I & II

I & III

I, II & III

II & III

Which of the following statements is FALSE?

Rebating is to offer a prospect a special inducement to purchase a policy

Twisting is a specific form of misrepresentation

Misrepresentation is a specific form of twisting

Switching is a facility allowing the policyholders to switch to another variable life funds offered by the company

Which of the following statements about variable life policies is TRUE? I. Offer price is used to determine the number of units to be credited to the account II. The margin between the bid and offer price is used to cover the managements cost of the policy III. The policy value is calculated based on the bid price of units allocated into the policy

I, II & III

I, & II

I & III

II & III

What is the most suitable investment instrument for an investor who is interested in protecting his principal and receiving a steady stream of income?

Equities

Warrants

Variable life policies

Fixed income securities

What are the disadvantages of investing in common shares? I. Dividends are paid more than fixed rates II. Investors are exposed to market and specific risks III. Shares can become worthless if company becomes insolvent

I & II

I & III

II & III

I, II & III

Which of the following statements about the difference between variable life policies and endowment policies are FALSE? I. The policy values of variable life policies directly reflect the performance of the fund of the life company II. The premiums and benefits of the endowment policies are described at the inception of the policy whereas variable life are flexible as the account are driven III. The benefits and risks of variable life and endowment policies directly accrue to the policyholders

I & II

I & III

I, II & III

II & III

. Which of the following statements about twisting is FALSE?

Twisting is a special form of misrepresentation

It refers to an agents including a policyholder to discontinue policy with another company without disclosing the disadvantage of doing so

It includes misleading or incomplete comparison of policies

It refers to an agent offering a prospect a special inducement to purchase a policy

Mr. Juan dela Cruz is currently earning Php 30,000.00 per month. He is 35 years old and he has a reasonable amount of savings. He has a moderate level of risk tolerance. What kind of policy would you recommend for him to buy?

Participating Endowment

Variable life policies

Participating whole life

Annuities

What are the benefits available when investing in variable life funds? I. The variable life funds offer policyholders an access to pooled or diversified portfolios II. The variable life policyholders can vary his premium payments, take premium holidays, add single premium top-ups and change the level of the sum assured easily III. The variable life policyholder can have access to a pool of qualified and trained professional fund managers

I & II

I & III

I, II & III

II & III

Rank the following in terms of their liquidity, from the least liquid to the most liquid: I. Short term securities II. Property III. Cash IV. Equities

IV, II, III, I

III, I, IV, II

II, I, IV, III

II, IV, I, III

A unit trust is ____________________

Established by a trust deed which enables a trustee to hold the pool of money and assets in trust in behalf of the investor

A close-end fund and does not have to dispose off if the large number investors sell their shares

One whereby the investor buys units in the trust itself and not share in the company

An organization registered under SECURITY EXCHANGE COMMISSION (SEC) which usually invests in a wide range of equities and other investment

Under variable life insurance policies ________________________ I. There is no guaranteed minimum sum assured for the purpose of declaring dividends II. There is no guaranteed minimum sum assured as a level of life insurance protection III. Each of the policy owner’s premium will be used to purchase units the number of which is dependent on the selling price of each unit IV. Purchase of units can only be made from the variable life fund itself, which will then create new units and add investment monies to the value of the fund

I & IV

II & IV

III & IV

II & III

The benefits of investing in variable life funds include ___________________ I. Policy owners have access to pooled or diversified portfolios of investment II. Policy owners can easily change the level of premium payments as the product design of variable life policies have clear structures which cater separately for investment and insurance protection III. Policy owners can gain access to variable life funds managed by professional investment managers with proven track records IV. Policy owners can buy a variable life insurance policy only with a high initial investment

I, II & IV

I, III & IV

I, II & III

II, III & IV

Which of the following BEST describes the policy benefits of variable life policies?

The policy benefits are payable only on death or disability

The policy benefits will depend on the long-term performance of the life company

The policy benefits are directly linked to the investment performance of the underlying assets

The policy benefits are guaranteed

Why it is important that the customer must understand the sales proposal in full?

Because the insurer does not guarantee any return

Because the impact of changes in investment condition on variable life policy is borne solely by the customer

Because the agent may give wrong recommendations

Because the policyholder expects higher returns

Which of the following statements about rebating are TRUE? I. Rebating is prohibited under Insurance Code II. Rebating deals with offering the prospect a special inducement to purchase policy III. Rebating will enhance the sales performance and uphold the prestige of an agent

I & II

I & III

II & III

Which of the following statement is FALSE?

Variable life insurance policies offer investors policies with values and indirectly linked to the investment performance of the life company

Life company will carry out a valuation of its funds yearly and any surplus may be allocated to participating policyholder as cash dividends

Both Whole Life and Endowment policies can be used as an investment media with benefits that become payable at a future date

The investment element of Variable life policies varies according to underlying assets of the portfolio

Which of the following statements about option top-up under variable life insurance is FALSE?

Policy owners may buy additional units of the variable life fund and these units will be allocated to new variable life insurance policies

Further premiums at time of top-up will be used in full, after deducting charges for top-ups, to purchase additional units of the variable life funds

Top-up policy, the policy owner pays further single premium at the time of the top-up

Policy owners are normally allowed to top-up their policies at any time, subject to a minimum amount

The characteristics of a variable life insurance include _______________________ I. Its withdrawal value and protection benefits are determined by the investment performance of the underlying assets II. Its protection costs are generally met by implicit charges III. Its commission and company expenses are met by a variety of explicit charges with normally 6 months notice given by the life companies prior to any change IV. Its withdrawal value is normally the value of units allocated to the policy owner calculated at the bid price

I, II & III

II, III & IV

I, II & IV

I, III & IV

Which of the following statements about single premium variable life policies are TRUE? I. There is no fixed term in a single premium variable life policy and therefore, they are technically whole life insurance II. Top-ups or single premium injections are allowed in these plans III. Policyholders have the flexibility of varying the level cover

I, II & III

II & III

I & II

I & III

Investing in bonds offer the following EXCEPT

Must be issued with a minimum death benefit

Must be issued with a maximum withdrawal value

It allows the investor a chance for capital preservation

It enables the investor an opportunity for capital appreciation

Which of the following statements about variable life policies are TRUE? I. The withdrawal value is not guaranteed II. The volatility of the returns depends on the investment strategy of the fund III. The variable life policyholder has direct control over the investment decisions of the variable life fund

I, II & III

I & II

I & III

II & III

Single premium variable life insurance policy :

Must issued with a minimum death benefit

Must be issued with a maximum withdrawal value

Has no death benefit

Has no withdrawal value

Which of the following statements about characteristics of variable life policies are TRUE? I. Variable policies generally have a longer exposure to equity investment than with participating and other traditional policies II. The protection costs are generally met by implicit charges, which vary with age and level of cover III. The commissions and company expenses are met by a variety of explicit charges, some of which are variable

I, II, III

I & II

II & III

I & III

Which of the following statements about benefits in variable life fund is FALSE?

The fund provides a highly diversified portfolio, thus, lowering the risk of investment

The fund ensures definite high yield for an investor since it is managed by professionals who are well-versed in the management of risk of investment portfolios

The fund relieves the investor from the hassle of administering his/her investment

The fund enables small investors to participate in a pool of diversified portfolio in which he/she, with a low investment capitals, is likely to have acceded to

The flexibility benefit of investing in variable life funds include ______________ I. Policy owners can easily change the level of sum assured and switch their investment between funds II. Policy owners can easily take premium holidays and add single premium to top-ups III. Variable life insurance policies offer the potential for higher returns IV. Traditional participating policies aim to produce a steady return by smoothing out market fluctuation

All of the above

I, II & III

I, II & IV

I, III & IV

The fundamental differences between traditional participating life insurance policies and variable life insurance policies include __________________ I. Variable life insurance policies are less likely to offer more choices in terms of the type of investment funds II. The investment elements of variable life insurance policies is made known to the policy owner at the outset and is invested in a separately identifiable fund which is made up of units of the investment III. Variable life insurance policies offer the potential for higher returns IV. Traditional participating policies aim to produce a steady return by smoothing out market fluctuation

I, III & IV

II, III, IV

I, II, III

I, II & IV

The switching facility under variable life insurance policies is a very useful _________

For the purpose of profit planning by the life policies

For the purpose of assets planning by the trustee

For the purpose of sales planning by the fund managers

For the purpose of financial planning by the policy owners

The following statement about surrender value under traditional participating life insurance products are TRUE?

Cash value is paid when yearly renewable term insurance policy is surrendered

When a participating insurance policy is surrendered, the surrender value is calculated by multiplying the bid price with the number of units

The amount of surrender value is usually higher than the amount under non-participating policies and it varies with the age of the assured, being lower at older ages

In the case of participating policies, the net cash surrender value includes the surrender value of the paid-up addition up to the date of surrender

Which one of the following statements about risks of investing in variable life funds is TRUE?

Policy owners who are risk averse should buy life insurance policies with high equity investment

Investment in variable life funds which are fully invested in units of equity bonds are not suitable for policy owners who can tolerate the risks of short term fluctuation in their cash value

Policy owners who invest in variable life funds with high equity investment face higher risk but can expect to achieve higher return than the traditional life insurance product over the long term

Policy owners who are risk averse should not purchase life insurance policies with high protection and guaranteed cash and maturity values

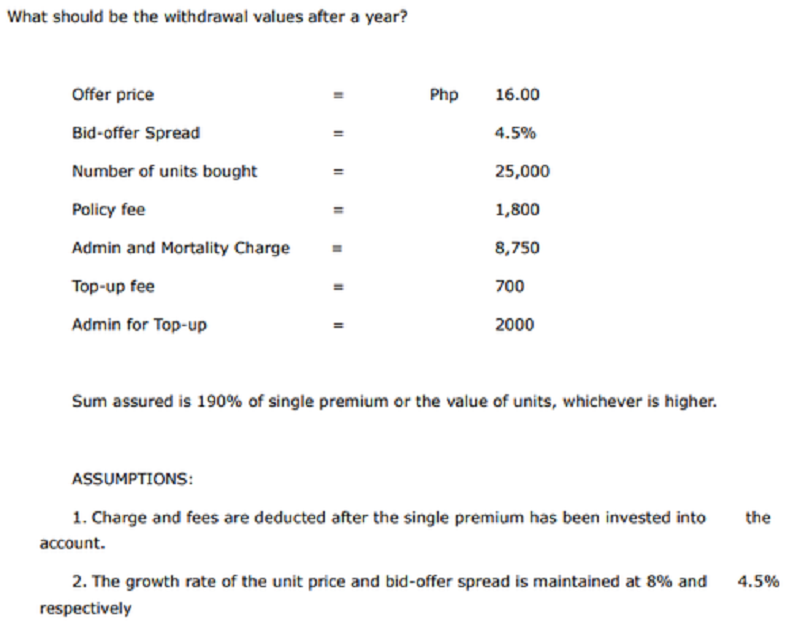

Php 432,000.00

Php 420,069.20

Php 401,107.58

Php 412,500.00

The protection cost under a variable life insurance policy ______________ I. Are must by flat initial charges for regular premium plans II. Are generally covered by cancellation of units in the fund III. Are generally met by explicit charges stipulated openly in the policy terms IV. Vary with age of policy owner and level of cover

I, II & III

I, II & IV

I, III & IV

II, III & IV

Which of the following statements about diversification in portfolio management is FALSE?

A diversified portfolio provides greater security to an investor having to sacrifice return for the portfolio

Diversification can completely eliminate the risk of investing in stocks in a portfolio

Diversification can involve purchasing different types of stocks and investing stocks in different countries

Diversification helps to spread the portfolio risk by investing in different categories of investment in a portfolio

What are the advantages of investing in preferred shares? I. It gives shareholder the right to a fixed dividend II. Has the priority over company assets during a dissolution III. They enjoy benefit of capital appreciation

I, II & III

I & II

I & III

II & III

With traditional participating life insurance products, the allocations to policy owners in the form of dividends _______________________ : I. Are not directly linked to the company’s investment performance II. Have already been smoothened by the life company III. Do not have the highs and lows of investment return as in good investments years of life company IV. Are not fixed at the inception of the policy, but are greatly dependent on the investment performance of the company

I, II & III

I, II & IV

I, III & IV

II, III & IV

The objective of satisfying customers need profitably can be achieved by and agent through I. The giving of freebies to the customers II. Extensive investment training by the company III. The use of sales plan, where sales goals, strategies, and objectives are coordinated with the market analysis, segmentation and training IV. The giving of monetary assistance and discount to the customers

I & III

II & III

II & IV

II, III & IV

Which of the following is true about CASH?

It has a high yield potential

Amount invested in cash depends on size of the cash flow requirement

Investment in cash increase when there is a bull run in the stock market

Investment in cash decrease when interest rates rise

Under a regular premium variable whole life plan ____________________ I. Premium top-ups and holidays, subject to the company’s administrative rules are usually allowed II. Life protection is the main objective of the plan with investment as the nominal purpose III. Withdrawal after the payment of a few years premium are usually allowed IV. A single premium contribution is made to the policy which uses the premium to purchase units in a variable life fund to provide a certain level of life cover

II, III & IV

I, III & IV

I, II & IV

I, II & III

Which of the following statements about investment objectives is false?

People invest money in fixed deposits to produce high and guaranteed returns

People invest money to enhance a comfortable standard of living

People invest money to provide funds for higher education for their children

Investment in commodities has no regular income

Which of the following is/are the main characteristic(s) of variable life policies? I. The policies can be used for investment, as a source of regular savings and protection II. The withdrawal values and protection benefits are determined by the investment III. The net cash values of the policies are the gross cash values shown in the policy that includes dividends up to the date of surrender less and indebtedness including interest

II

I

I, II & III

I & II

Risk can be classified into two particular categories in relation to investment. They include ___________ : I. The risk of not losing some or all of the person’s initial investment II. The risk of rate of return on the investment not matching up to the individual’s expectation III. The risk of rate of return on the investment matching up to the individual’s expectation IV. The risk of losing some or all of a person’s initial investment

I & III

I & II

III & IV

II & IV

The duties of the trustee of unit trust do not include:

Managing the portfolio of investment and administering the buying and selling of shares in the unit trust itself

Ensuring that the fund manager adhere to the provision of the trust deeds

Acting generally to protect the unit-holders

Holding the pool of money and shares and assets in trust in behalf of the investors

Policy fee payable by variable life insurance policy owner is to cover _________________

The handling charges by professional investment managers

The price of each unit bought under the variable life insurance policy

The mortality cost of the variable life insurance policy

The administrative expenses of setting up the variable life insurance policy

The selling price under a variable life insurance policy is:

The price at which units under the policy are bought back by the life insurance company

The price at which units under the policy are offered for sale by the life company

Also known as the bid price

A fixed amount throughout the life of the policy

Diversification in investment involves ______________________:

Putting all the funds under management into one category of investment

Spreading the risk of investment by not putting the fund into several categories of investment

Reducing the risks of investment by putting one fund under management into several categories of investment

Reducing the risks of investment by putting all one’s eggs in one basket

Variable life funds can be invested in any financial instruments including cash funds, bond funds, equity funds, property funds, specialized funds, and diversified funds. Equity funds _________ :

Invest in shares of stocks and the magnitude of the change in unit prices will only depend on the quantity of the equities held

Invest in shares of stocks and during market recession, such as assets are usually the last to depreciate

Invest in shares of stocks which are inherently of lower risk in nature and the prices of stocks are stable

Invest in shares of stocks and investors who buy such assets usually aim for capital appreciation

Which of the following statements describe the differences between variable life products and participating products? I. Variable life products allow policyholders to vary the premium payments unlike participating products II. Variable life products can take the form of whole life or endowment policies with participating products III. Variable life products allow policyholders to pay future single premiums from time to time to add more units to his account unlike participating products

I, II and III

I

I and III

II and III

{"name":"Exam Prulife", "url":"https://www.quiz-maker.com/QPREVIEW","txt":"Test your knowledge on life insurance with our comprehensive quiz designed for both beginners and professionals. With 105 carefully crafted questions, this quiz will challenge your understanding of life insurance concepts and policies.Discover if you have what it takes to grasp essential life insurance principles and enhance your expertise.Multiple-choice questionsInstant feedback on your answersLearn about life insurance policies, riders, and provisions","img":"https:/images/course5.png"}

More Quizzes

Traditional Exam

50250

51-100

502534

Sonic

210

Which Jin Ling uncle are you?

844330

Free CFA Level 1 Practice Questions

201017362

What Are the Two Main Things to Look for Ahead? CDL

201019958

Wrestling IQ - Test Your Knowledge for Free

201016629

FANBOYS: Test Your Coordinating Conjunctions

201017561

HIPAA Compliance Testing - Free Training Online

201016080

Eyebrow Shape Generator - Find Your Best Brow

201017362

Hunter Safety Practice Test - Free Hunter Ed Prep

201017628

Which Outer Banks Character Is Your Soulmate? - Free

201016629