International Finance Mock paper

International Finance Quiz

Test your knowledge with our comprehensive International Finance quiz! This engaging online quiz is designed to help you prepare for your in-class tests while covering key concepts in foreign exchange, balance of payments, and international investments.

Get ready to challenge yourself with questions covering:

- Foreign Exchange Risk

- Balance of Payments

- Capital and Current Accounts

- Investment Calculations

Welcome to the online quiz of International Finance. This test comprises 20 MC questions and every question has one correct answer. Please note that this test is solely for the preparation purpose of the in-class test and test is not assessed as a part of the module coursework structure. Click below to start the test.

Start test

Which one of the below best describes foreign exchange risk?

The risk that foreign currency profits may evaporate in dollar/sterling/yuan (local currency) terms due to unanticipated unfavorable exchange rate movements.

Risk that the local currency will depreciate against their major trading partners in the global economy, which in turn reduce the competitiveness of the domestic exports in overseas markets

The risk that foreign currency appreciates against the domestic currency, as such the international competitiveness of the domestic currency will weaken in the forex markets

It is the risk of a country’s currency being vulnerable for a speculative attack.

What differenciates a free trade area from a preferential trading area.

A common economic policy between all of its member countries

Members to share a common trade policy against non-member states

Free movement of resources among nations (eg: Labor resources)

Member states to maintain their own trade policies against the non-member states.

Which of the following is not a part of the definition of the BoP

It is a statistical record

Of a country’s International transactions

As well as the domestic transactions that are included in GDP calculations

Over a period of time

If France exports 60 Mn worth of wine to the UK, this will be recorded as

Credits in France Current account and debit in UK Capital account

Credit in France current account and debit in UK current account

Credit in UK current account and debit in France current account

None of the above.

The current account excludes

The export and import of goods and services.

Statistical discrepancies.

Factor income earned abroad.

Donations and reparations.

The capital account excludes

Investments in foreign portfolio of assets.

All purchases and sales of assets such as stocks, bonds, bank accounts, real estate, and businesses.

Investment income earned from foreign investments such as stocks, bonds, bank accounts, real estate, and businesses.

None of the above

Select the most appropriate definition for the Official settlement balance

OSB is the payment gap that needs to be accommodated with the government’s official reserves

OSB is equal to the summation of BCA, BKA and the BRA minus the official reserves balance

OSB is the amount of reserves held by the central government for official transactions.

OSB is the value of countries exports minus the imports and does not include the statistical discrepancies as it usually accounts for a smaller fraction of the GDP.

If the UK demand for US goods start to increase, which of the following consequences are most likely to happen?

UK exports are likely to decline.

Imports from UK to US will increase the GBP will appreciate owing to higher demand levels.

Imports from UK to US will increase and USD will appreciate owing to lower demand levels

Imports from US to UK will increase and the USD will appreciate owing to higher demand levels.

If the relative interest rates in the US reduces which of the following is most likely to happen

The interest in rest of the world will show a similar trend

The BoP deficit will increase owing to lower capital inflows.

Capital inflow to the US will increase resulting in a surplus in the capital account.

The USD will appreciate

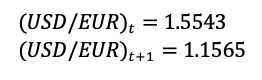

Screen Shot 2020-03-30 at 23.32.12

Based on the above currency quotations what is the appreciation/ depreciation of the USD against the EUR

-25.59%

-34.39%

25.59%

34.39%

Mark runs a restaurant chain and wishes to undertake the following investment. This investment has an initial cash outlay of £30,000, and will return £40,000 for the next 5 years. On the sixth year, Mark needs to invest another £22,000 to this project and on the tenth year, he receives a final payment of £75,000 if Mark’s opportunity cost of capital is 7.0%. What is the NPV of the project

£147,402.39

£157,474.57

£137,403.35

£126,331.78

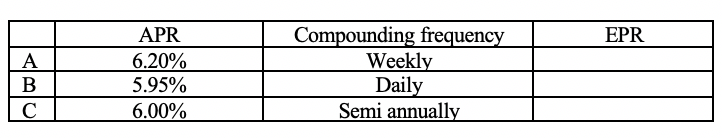

Rob manufacture toilet papers and wishes to expand his business to cater the increasing demand levels. He intends to buy the adjoining building to install new machineries and increase the daily production capacity. He has obtained the quotations from three local banks for a loan worth of £500,000. To make his life easier, he wishes to consult a financial expert to rank these financing opportunities from best to worse.

Screen Shot 2020-03-30 at 23.42.19

Screen Shot 2020-03-30 at 23.43.57

CAB

BCA

CBA

BAC

During the period of the classical gold standard (1875-1914) there were

Highly volatile exchange rates.

Volatile exchange rates.

Moderately volatile exchange rates.

Stable exchange rates.

Under the gold standard, international imbalances of payment will be corrected automatically under the

Gresham Exchange Rate regime.

European Monetary System.

Price-specie-flow mechanism.

Bretton Woods Accord.

If the €/$ bid and ask prices are 0.6567-77, respectively, the corresponding $/€ bid and ask prices are

�1.5204 and €1.5228

$1.5204 and $1.5228

$1.5228 and $1.5204

�1.5228 and €1.5204

If Dealer X quotes the $/£ bid ask spread as 1.2454-67. This means that

You can buy one GBP for $1.2454

You can sell one GBP for $1.2467

You can buy one GBP for $1.2467

You can buy one USD for $1.2467

Suppose that the current exchange rate is £0.6740 = $1.00. The direct quote, from the U.S. Perspective is

£1.00 = $1.4838.

$1.00 = £1.4838.

£1.00 = $1.80.

None of the above

Which of the following statements are correct?

- Managed float allows the government to intervene in exchange rate management.

- Fixed exchange rate system frees the government from holding foreign reserves.

- Crawling peg is more like a fixed exchange rate system.

- Pure floating exchange rate system is also referred as a dirty float.

I,ii,iv only

Ii,iii,iv only

I,iii only

All are correct

Which of the following is an advantage of the fixed exchange rate system?

Frees the government from holding foreign exchange reserves

Ensures stability in exchange rates and eliminates the risk of speculator attacks on a currency

Surpluses and deficits are automatically corrected.

None of the above

Which of the following is a disadvantage of the fixed exchange rate system?

Induces higher volatilities in exchange rates.

Makes a currency vulnerable for speculation.

Possibility of currency over/ undervaluation.

All of the above.

{"name":"International Finance Mock paper", "url":"https://www.quiz-maker.com/QPREVIEW","txt":"Test your knowledge with our comprehensive International Finance quiz! This engaging online quiz is designed to help you prepare for your in-class tests while covering key concepts in foreign exchange, balance of payments, and international investments.Get ready to challenge yourself with questions covering:Foreign Exchange RiskBalance of PaymentsCapital and Current AccountsInvestment Calculations","img":"https:/images/course3.png"}

More Quizzes

Contemporary Economic Issues

472432

���ავი 13

136140

Erudite Quiz Class 6 and 7 Level 2

1580

BREATH OF THE WILD

12612

Arabic Words - Free Online Challenge

201016679

Yu-Gi-Oh! GX Duel Academy Exam Answers - Entrance

201018039

Which Is Not an Algebraic Spiral? Spot the Outlier

201017419

Bleach Character - Which Soul Reaper Are You?

201018804

2.03: The American Revolution - Free Practice

201019484

Hormone Type - Which Hormone Profile Are You?

201018804

American Food Trivia - Free Online Challenge

201018723

Business Finance - Free Knowledge Assessment

201016179