Modules 5 and 6

Economic Insights Quiz

Test your knowledge on the intricacies of GDP and national income accounting with this comprehensive quiz. It covers various aspects of economics, including government purchases, net exports, and more.

Perfect for students and anyone interested in economics!

- 50 Thought-provoking questions

- Multiple choice format

- Enhance your understanding of economic concepts

1. The following data about a hypothetical economy are in billions of dollars.

Refer to the above data. GDP in this economy is:

$6,380 billion

$6,230 billion

$6,080 billion

$6,400 billion

2. The following are examples of final goods in national income accounting, except:

Laptop computer purchased by an executive for personal use

Tractor purchased by a construction company

Lumber and steel beams purchased by a construction company

Desktop computer purchased by an executive for business use

3. Government purchases in national income accounts would include payments for:

Public assistance for welfare recipients

Social Security checks to retirees

Unemployment benefits

Salaries for current Canadian military officers

4. O avoid multiple counting in national income accounts:

Both final and intermediate goods and services should be counted

Intermediate goods and services should be counted

Primary, intermediate, and final goods and services should be counted

Only final goods and services should be counted

5. To avoid multiple counting in national income accounts:

$3,846 billion

$3,925 billion

$4,379 billion

$4,108 billion

6. The following data about a hypothetical economy are in billions of dollars.

Refer to the above data. How much are net exports of this economy?

-$65 billion

+$20 billion

+$150 billion

-$20 billion

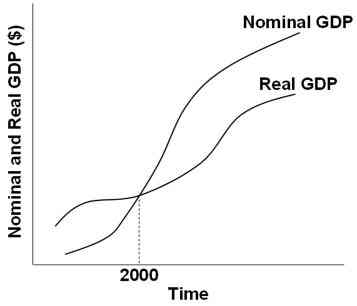

7.

Refer to the graph above. The year 2000 must be the:

Point in time when GDP equaled 100

Year when the GDP price index is zero

Base year of the GDP price index

Year when depreciation or capital consumption equaled zero

8. A distinguishing characteristic of public transfer payments is that:

They involve no contribution to current production in return

They are counted as part of government purchases in the calculation of the gross domestic product

They include wages to government workers

They include the cost of maintaining public parks

9. (The following national income data for an economy are in billions of dollars.)

f1q59g1

Refer to the above data. The expenditures approach to GDP calculation can be done by adding:

1 through 7

2 through 7

3 through 8

8 through 11

10. Nominal GDP is less than real GDP in an economy in both year 1 and year 2. In year 3, nominal GDP is equal to real GDP. In year 4, nominal GDP is slightly greater than real GDP. In year 5, nominal GDP is significantly greater than real GDP. Which year is the base year being used to calculate the price index for this economy?

3

2

4

5

11. "GDP price index" measures changes in the:

Cost of resources employed in the nation

Prices of the output produced in the nation

Value of final output produced in the nation

Amount of resources available in the nation

12. The "underground economy" is mostly made up of:

Tax-evasion activities

Do-it-yourself activities

Illegal activities

Unpaid work

13. GDP tends to underestimate the productive activity in the economy because it excludes the value of output from:

Intermediate goods

The underground economy

The consumption of fixed capital

Public transfer payments to households

14. The following are incomes earned but not received by the nation's households, except:

Corporate income taxes

Transfer payments

Social security contribution

Undistributed corporate profits

15. Gross domestic private investment, as defined in national income accounts, would include the following, except:

Changes to business inventories

The value of all capital goods bought by business firms

Government construction of new highways and dams

All domestic construction done by the private sector

16. Value added by a firm is the market value of the firm's output minus the:

Total costs of all inputs used

Profits that the firm's owners earn

Value of inputs bought from other firms

Total wages paid to its employees

17. When local police and fire departments buy new cars for their operations, these are counted as part of:

C

Ig

Xn

G

18. GDP in an economy is $11,050 billion. Consumer expenditures are $7,735 billion, government purchases are $1,989 billion, and gross investment is $1,410 billion. Net exports must be:

-$47 billion

-$84 billion

+$53 billion

-$161 billion

19. Which of the following is included in the expenditures approach to GDP?

Expenditures on used clothing at garage sales

Spending on meals by consumers at restaurants

Government spending on welfare payments

Value of stocks and bonds bought by businessmen

20. Which would be considered an investment according to economists?

A fishing-company owner buys new fishing gear

A fishing-company owner buys Google shares

A fishing-company buys a few boats from another fishing company that was closing out

A fishing-company owner buys fuel to run the boats

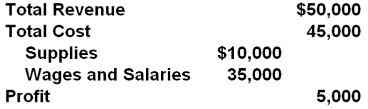

21. Consider the following data for a firm over a period of time. The contribution of the firm to domestic output by the value-added method is:

$50,000

$40,000

$45,000

$5,000

22. The total volume of business sales in our economy is several times larger than GDP because:

The GDP excludes intermediate transactions

The GDP grossly understates the value of our annual output

The GDP does not take taxes into account

Total sales are in money terms and GDP is always stated in real terms

23. Net exports is a positive number when:

A nation's exports of goods and services are increasing

A nation's exports of goods and services fall short of its imports

A nation's exports of goods and services exceed its imports

A nation exports goods and services to other nations

24. GDP does not include which of the following activities?

Households spending to enhance security of their neighborhoods

Businesses installing anti-pollution equipment

Families eating out in restaurants

Correct Couples remodeling their own homes

25. Subtracting the purchase of intermediate products and supplies from the value of the sales of final products determines the amount of:

Net investment for a business

Correct Value added from the economic activity

Surplus or deficit from the economic activity

Profit and cost

26. An increase in aggregate demand is most likely to be caused by:

A decrease in the tax rates on household income

A decrease in government spending

A decrease in expected returns on investment

An increase in real interest rates

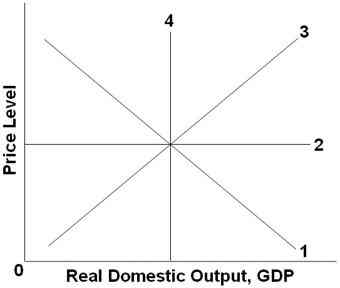

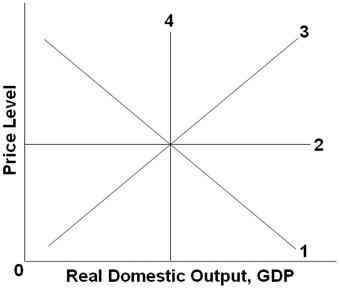

27.

Refer to the graph above. The long-run aggregate supply curve would be represented by which line?

1

2

3

4

28. An aggregate supply curve represents the relationship between the:

Price level that producers are willing to accept and the price level buyers are willing to pay

Real domestic output bought and the real domestic output sold

Price level and the production of real domestic output

Price level and the buying of real domestic output

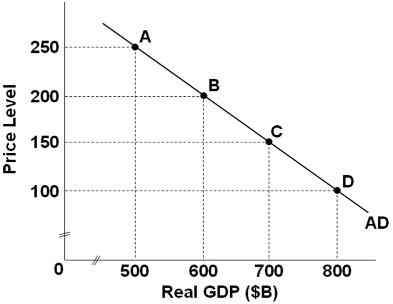

29.

Refer to the graph above, which shows an aggregate demand. If the economy is at point C and the price level increases by 100, then the wealth, interest-rate, and foreign purchases effects will:

Move the economy to point B

Shift the AD curve to the left

Move the economy to point A

Move the economy to point D

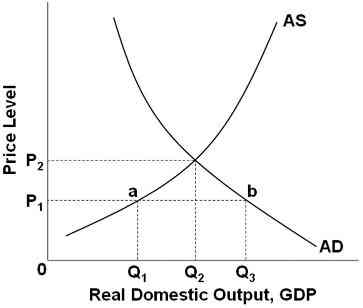

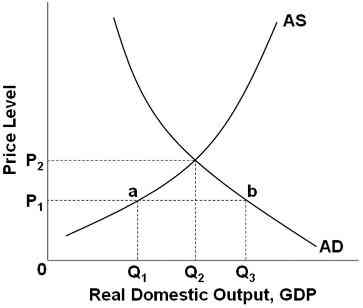

30.

Refer to the graph above. The equilibrium for this economy is:

At point a

At point b

At price level P2 and output Q2

At price level P1 and output Q1

31. A decrease in government spending will cause a(n):

Increase in the quantity of real output demanded

Increase in aggregate demand

Decrease in aggregate demand

Decrease in the quantity of real output demanded

32. The real-balances effect on aggregate demand suggests that a:

Lower price level will decrease the real value of many financial assets and therefore cause an increase in spending

Higher price level will increase the real value of many financial assets and therefore cause an increase in spending

Lower price level will decrease the demand for money, decrease interest rates, and increase consumption and investment spending

Lower price level will increase the real value of many financial assets and therefore cause an increase in spending

33. The labels for the axes of an aggregate supply curve should be:

Real domestic output for the vertical axis and price level for the horizontal axis

Real domestic output for the horizontal axis and price level for the vertical axis

Real employment for the vertical axis and price level for the horizontal axis

Aggregate demand for the vertical axis and real national output for the horizontal axis

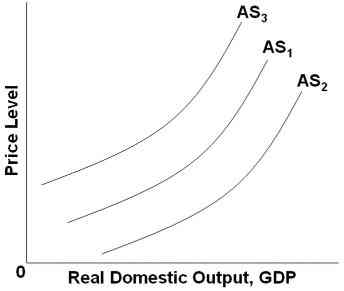

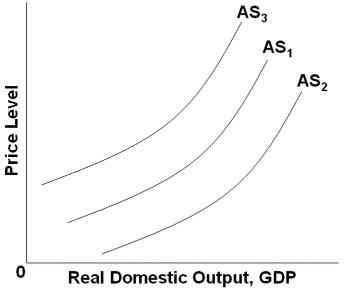

34.

Refer to the graph above. Which of the following factors will shift AS1 to AS2?

An increase in input prices

A decrease in business subsidies

A decrease in business taxes

An increase in real interest rates

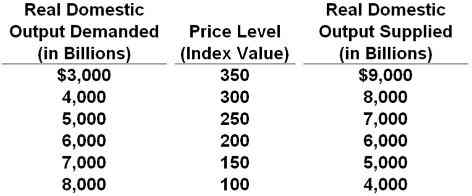

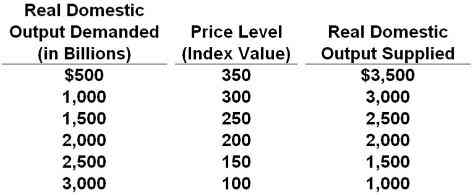

35. The table below shows the aggregate demand and aggregate supply schedules for a hypothetical economy.

Refer to the table above. The equilibrium price and output levels will be:

200 and $6000

250 and $7000

200 and $5000

300 and $8000

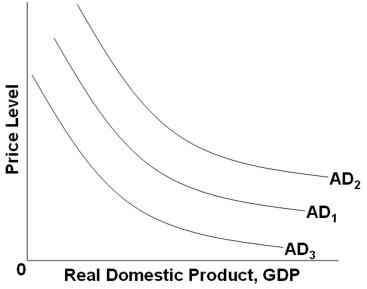

36.

Refer to the graph above. Which of the following changes will shift AD1 to AD2?

An increase in real interest rates

A cut in personal and business taxes

A shrinkage in the value of stocks and other financial assets

An increase in the value of the dollar relative to other currencies

37. If personal income taxes and business taxes increase, then this will:

Increase aggregate demand and aggregate supply

Decrease aggregate demand and increase aggregate supply

Increase aggregate demand and decrease aggregate supply

Decrease aggregate demand and aggregate supply

38.

Refer to the graph above. Which of the following factors will shift AS1 to AS3?

An increase in input prices

A decrease in business taxes

A decrease in household indebtedness

An increase in productivity

39. When the excess capacity of business expands unintentionally, aggregate:

Demand will increase

Supply will increase

Demand will decrease

Supply will decrease

40. Which would most likely shift the aggregate supply curve? A change in the prices of:

Domestic products

Foreign products

Resources

Financial assets

41. An increase in productivity will:

Increase aggregate supply and aggregate demand

Increase aggregate supply

Decrease aggregate supply and aggregate demand

Increase aggregate demand

42.

Refer to the graph above. If the price level is initially at P1, then the economy will adjust by:

Reducing the price level

Decreasing the GDP produced

Increasing the total output demanded

Increasing output produced

43. The aggregate demand curve shows the:

Direct relationship between real-balances and the quantity of real GDP purchased

Inverse relationship between interest rates and the quantity of real GDP produced

Direct relationship between the price level and the quantity of real GDP produced

Inverse relationship between the price level and the quantity of real GDP purchased

44. The aggregate demand curve or schedule shows the relationship between the total demand for output and the:

Interest rate

Income level

Price level

Real GDP

45. The foreign purchases effect on aggregate demand suggests that a:

Rise in our domestic price level will increase our imports and reduce our exports, thereby reducing the net exports component of aggregate demand

Fall in our domestic price level will decrease our imports and increase our exports, thereby reducing the net exports component of aggregate demand

Fall in our domestic price level will increase our imports and reduce our exports, thereby reducing the net exports component of aggregate demand

Rise in our domestic price level will decrease our imports and increase our exports, thereby reducing the net exports component of aggregate demand

46. The foreign purchases, interest rate, and real-balances effects explain why the:

Aggregate demand curve may shift to the left or right

Aggregate demand curve is downward-sloping

Aggregate expenditures schedule may shift up or down

Economy will adjust towards equilibrium

47. It shows the aggregate demand and aggregate supply schedule for a hypothetical economy.

Refer to the table above. If the quantity of real domestic output demanded increased by $1000 at each price level, the new equilibrium price level and quantity of real domestic output would be:

200 and $2000

300 and $3000

150 and $2500

250 and $2500

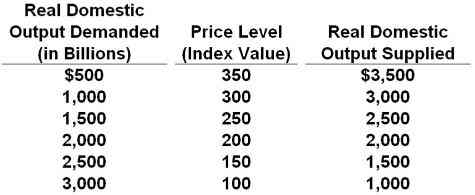

48. T shows the aggregate demand and aggregate supply schedule for a hypothetical economy.

Refer to the table above. If the quantity of real domestic output demanded decreased by $500 and the quantity of real domestic output supplied increased by $500 at each price level, the new equilibrium price level and quantity of real domestic output would be:

150 and $2000

200 and $2000

150 and $1500

250 and $2000

49. The labels for the axes of the aggregate demand graph should be:

Price of a product on the vertical axis and quantity of a product on the horizontal axis

Real domestic output on the vertical axis and the price level on the horizontal axis

Real domestic output on the horizontal axis and the price level on the vertical axis

Quantity of a product on the vertical axis and the price of a product on the horizontal axis

50.

Refer to the graph above. Which line might represent an immediate-short-run aggregate supply curve?

1

2

3

4

{"name":"Modules 5 and 6", "url":"https://www.quiz-maker.com/QPREVIEW","txt":"Test your knowledge on the intricacies of GDP and national income accounting with this comprehensive quiz. It covers various aspects of economics, including government purchases, net exports, and more.Perfect for students and anyone interested in economics!50 Thought-provoking questionsMultiple choice formatEnhance your understanding of economic concepts","img":"https:/images/course5.png"}

More Quizzes

1-2 თავის ტესტები

1050

National income aggregates

6377

SPIM Valentine's Day Trivia

14715

Anesthesie-Reanimation

16482183

Radiographic Upper Extremity Anatomy - Test Skills

201054460

Test Your Skills with the Ultimate African Music!

201060497

Bree from Lab Rats: Only True Fans Score 100%

201028387

Scholarship Questions & Answers - Test Your Skills

201026712

Introduction to Field Methods

15833975

Free Biotechnology Worksheet

201026974

Personal Fashion: Unlock Your Signature Style

201027243

Free 5 Southern Colonies Practice

201023991