INTERMEDIATE ACCOUNTING 2: COMPUTATIONAL

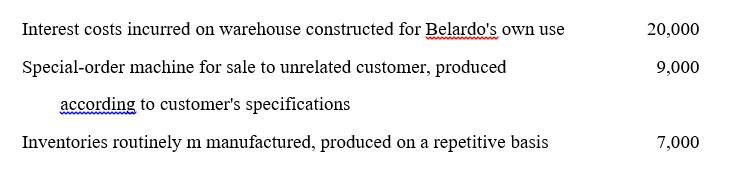

All of these assets required an extended period of time for completion. Assuming the effect of interest capitalization material, what is the total amount of interest costs to be capitalized?

A company made the following cash expenditures on a self-constructed building begun January 1 of the current year:

January 1 P 50,000

June 1 P 60,000

December 1 P 90,000

The building is still under construction at year-end. What is the average accumulated expenditures for the purpose of capitalizing interest?

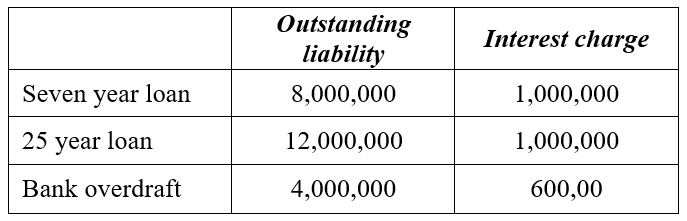

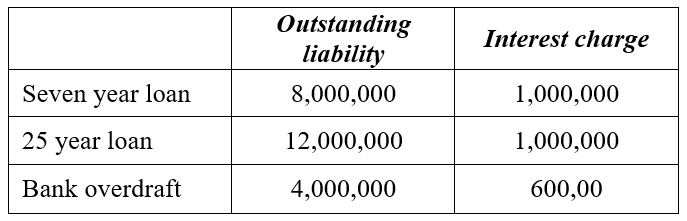

An entity has three sources of borrowings in an accounting period:

If all of the borrowings are used to finance the production of qualifying asset, but none of the borrowings relate to a specific qualifying asset, what is the capitalization rate?

An entity has three sources of borrowings in an accounting period:

If the seven-year loan is an amount which can be specifically identified with a qualifying asset, what is capitalization rate?

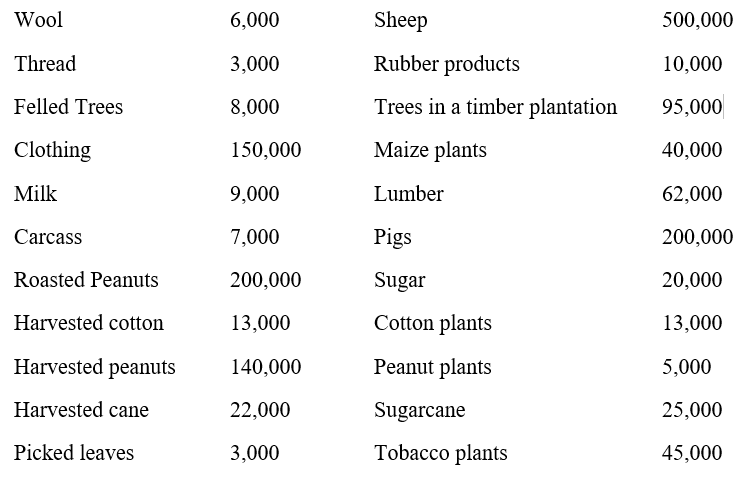

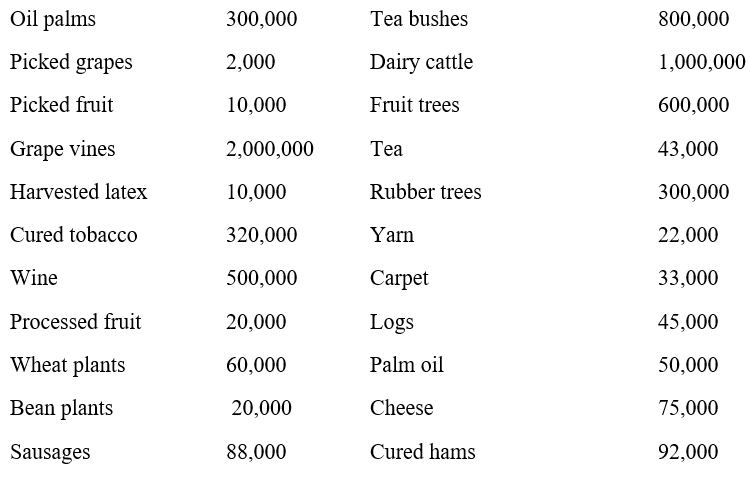

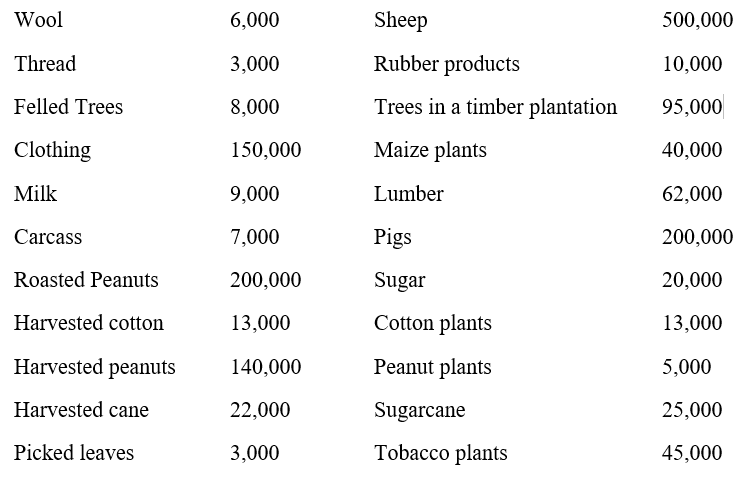

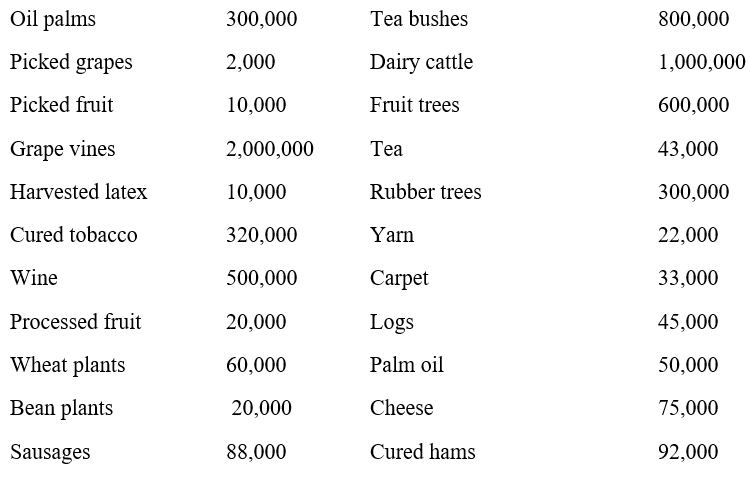

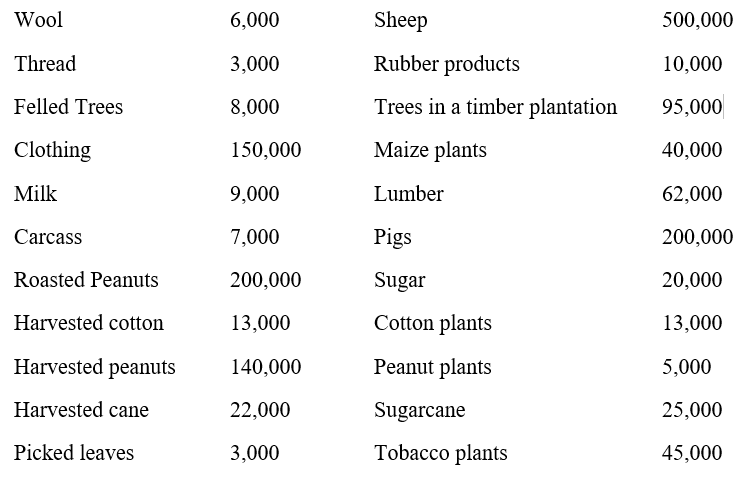

The following information pertains to Madagascar Co.

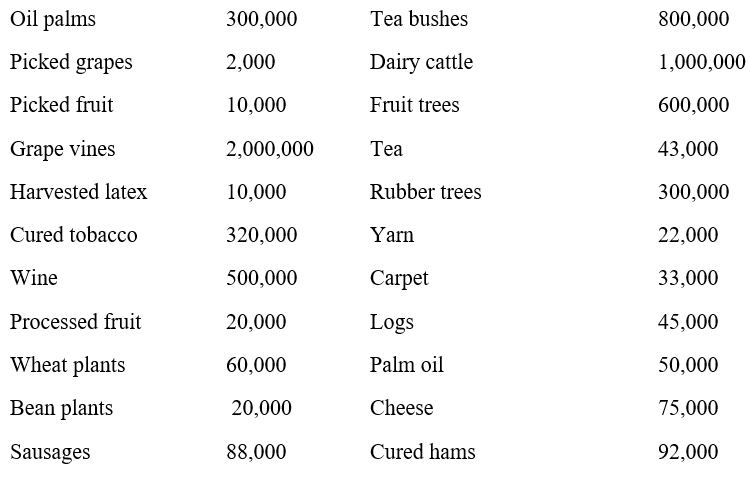

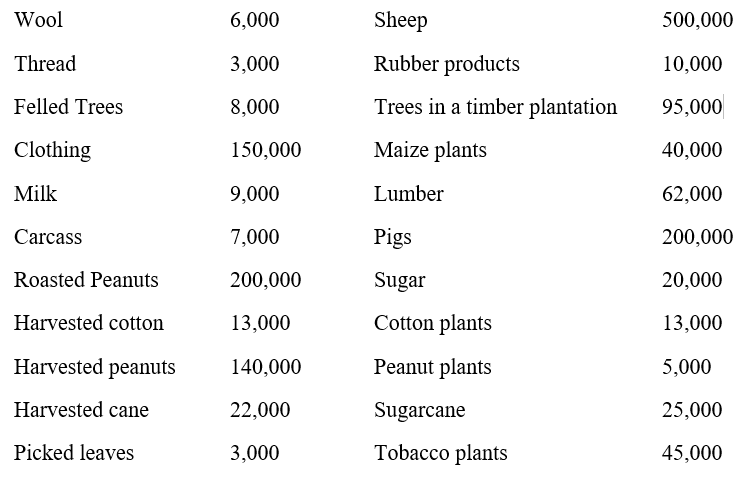

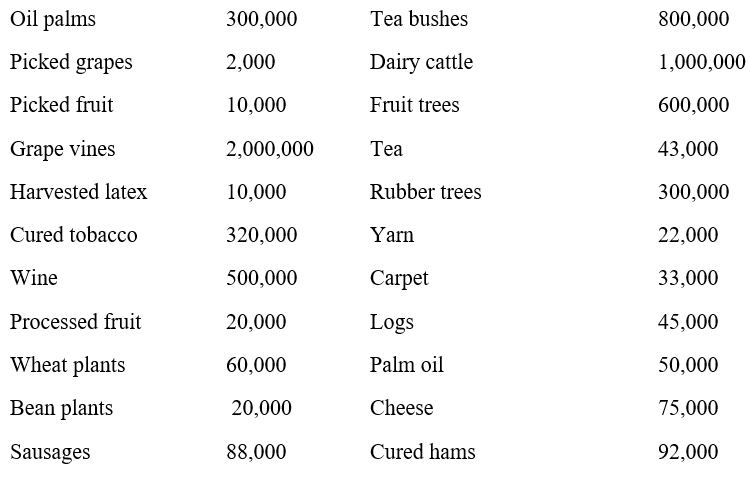

How much is classified as biological assets that are accounted for under PAS 41 Agriculture?

The following information pertains to Madagascar Co.

How much is classified as property, plant and equipment thatare accounted for under PAS 16 Property, Plant and Equipment?

The following information pertains to Madagascar Co.

How much is classified as agricultural produce?

The following information pertains to Madagascar Co.

How much is classified as inventory?

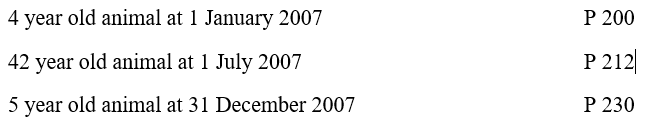

How much is the gain to be recognized from the change in fair value less costs to sell in 2007?

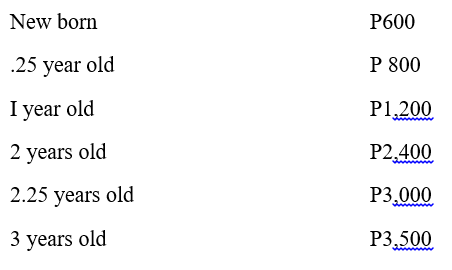

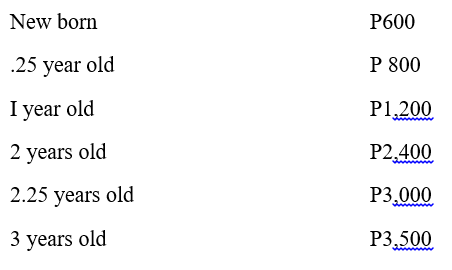

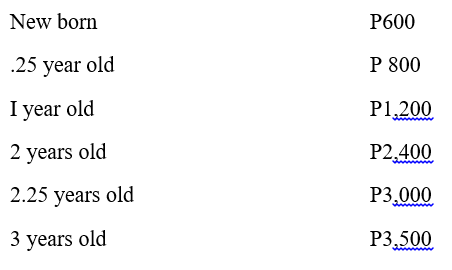

ABC Co. Has three, 1-year old, animals with amount total carrying of P3,000 on January 1, 20x1. On March 31, ABC Co. Acquired two animals, aged 2.25 years old each, for P2,000 each, the fair value less costs of the animals on this date. Six animals were born on October 1, 20x1. The fair value less costs to sell of a new born animal on this date is P500. ABC Co. Determined the following fair values less costs to sell on December 31, 20x1:

How much is the total gain (loss) from the change in FVLCS during the period?

ABC Co. Has three, 1-year old, animals with amount total carrying of P3,000 on January 1, 20x1. On March 31, ABC Co. Acquired two animals, aged 2.25 years old each, for P2,000 each, the fair value less costs of the animals on this date. Six animals were born on October 1, 20x1. The fair value less costs to sell of a new born animal on this date is P500. ABC Co. Determined the following fair values less costs to sell on December 31, 20x1:

How much is the change in FVLCS due to price change?

ABC Co. Has three, 1-year old, animals with amount total carrying of P3,000 on January 1, 20x1. On March 31, ABC Co. Acquired two animals, aged 2.25 years old each, for P2,000 each, the fair value less costs of the animals on this date. Six animals were born on October 1, 20x1. The fair value less costs to sell of a new born animal on this date is P500. ABC Co. Determined the following fair values less costs to sell on December 31, 20x1:

How much is the change in FVLCS due to physical change?

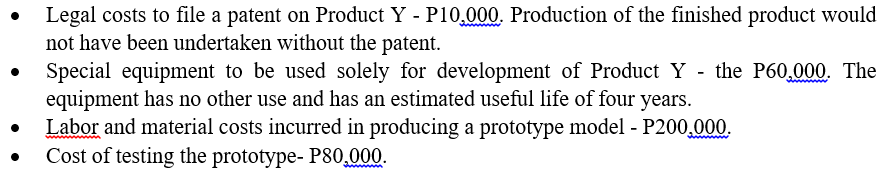

West, Inc. Made the following expenditures relating to Product Y:

What is the total amount of costs that will be expensed when incurred?

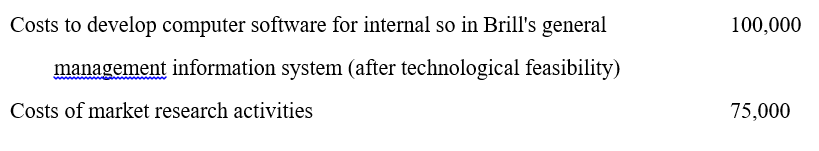

What amount of these expenditures should Brill report in its 20×3 income statement as research and development expenses?

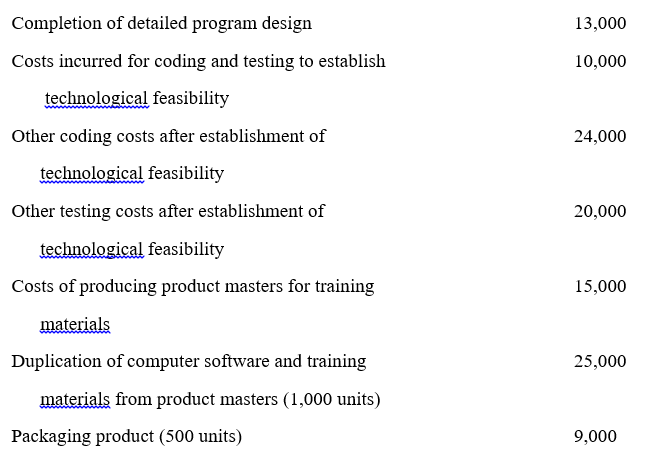

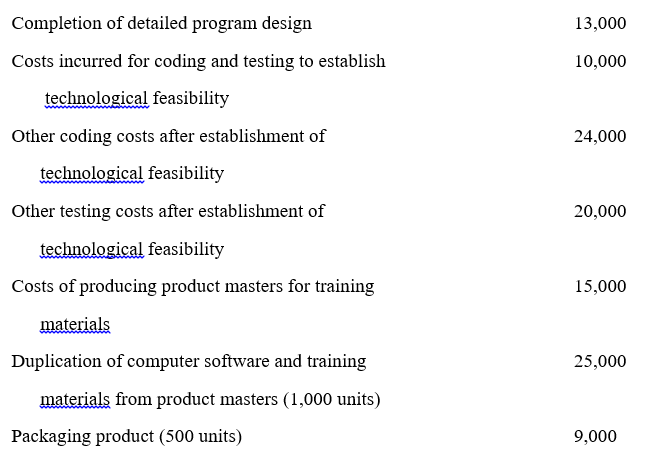

During 20x3, Pitt Corp. Incurred costs to develop and produce a routine, low-risk computer software product, as follows:

In Pitt's December 31, 20x3 balance sheet, what amount should be reported in inventory?

During 20x3, Pitt Corp. Incurred costs to develop and produce a routine, low-risk computer software product, as follows:

In Pitt's December 31, 2023 balance sheet, what amount should be capitalized as software cost, subject to amortization?

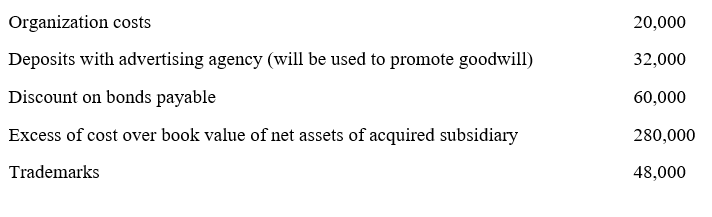

In the preparation of Flayle's balance sheet as of December 31, what should be reported as total intangible assets to be accounted for under PAS 38 Intangible assets?

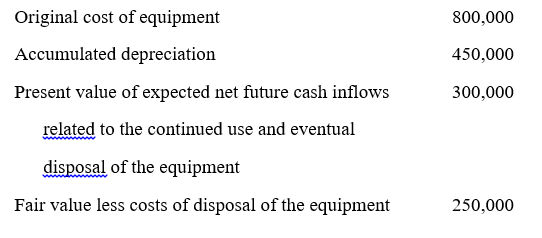

What is the amount of the impairment loss that should be reported on Toni's income statement prepared for the year ended December 31, 20x3?

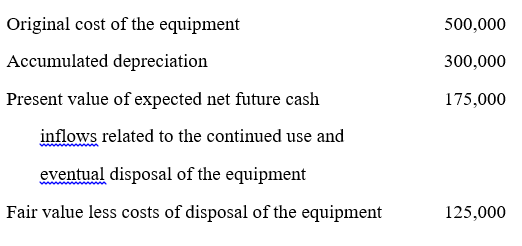

What is the amount of impairment loss that should be reported on Bubba's income statement prepared for the year ended December 31, 20x3?

A company operates a mine in a country where legislation requires that the owner must restore the site on completion of its mining operations. The cost of restoration includes the replacement of the overburden, which must be removed before mining operations commence. A provision for the costs to replace the overburden was recognized as soon as the overburden was removed. The amount provided was recognized as part of the cost of the mine and is being depreciated over the mine's useful life. The carrying amount of the provision for restoration costs is P500,000, which is equal to the present value of the restoration costs.

The entity is testing the mine for impairment. The cash-generating unit for the mine is the mine asa whole, Theo has received various offers to buy the mine at a pice of around P800,000. The price reflects the fact that the buyer will assume the obligation to restore the overburden. Disposal costs for the mine are negligible. The value in use of the mine is approximately P1,200,000, excluding restoration costs. The carrying amount of the mine is P1,600,000.

How much is the impairment loss?

The amount of impairment loss to be recognized by Happy Company is