Objection Handling Quiz

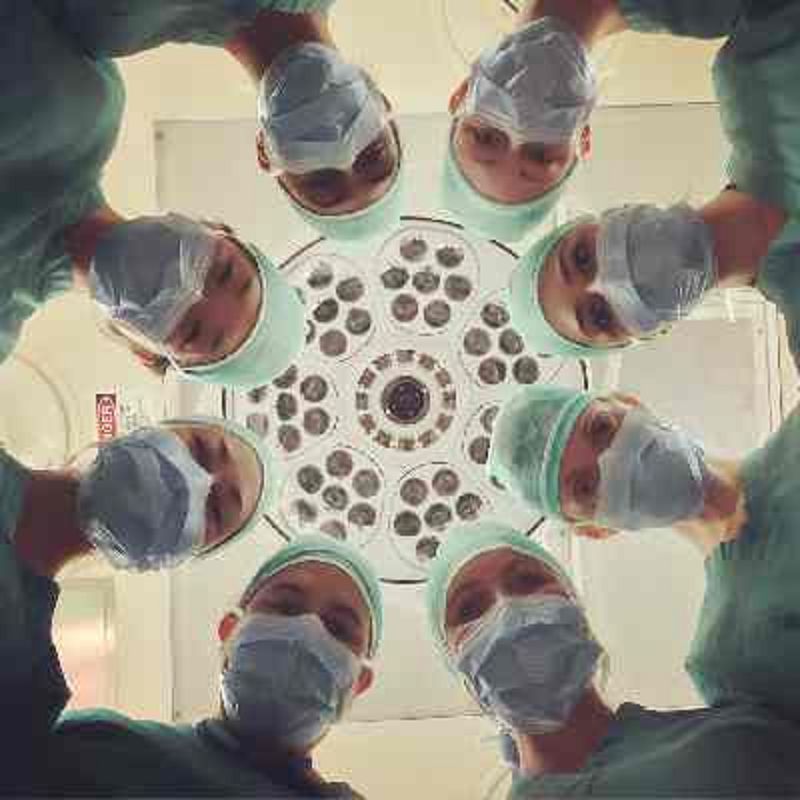

{"name":"Objection Handling Quiz", "url":"https://www.quiz-maker.com/QPREVIEW","txt":"Test your knowledge on objection handling related to health insurance with this engaging quiz! Understand the intricacies of accident benefits, daily illness coverage, and specialist visits.Multiple choice questionsLearn about insurance policiesAssess your knowledge in a fun way","img":"https:/images/course1.png"}

More Quizzes

Know Your AXA Products Quiz

14772

TotalSecure+ Assessment

201094

Who Wants to Be A Millionaire - Fastest Finger First

100

TEST 1

5221

God's Love Bible - Test Your Scripture Knowledge

201020991

Unit Circle Test - Free Online Practice Questions

201017517

What Is My Theme Song? Free Personality

201019670

Menopause - Test Your Knowledge of Symptoms & Facts

201026043

Which AU Sans Are You? Undertale Sans or Papyrus

201019670

5th Grade Social Studies Questions - Free Practice

201023488

What Is My Spiritual Gift? - Free, Instant Results

201018465

What Type of Dominant Are You? Free Role

201018815