CDH Reviewer

Master the Pega Customer Decision Hub

Test your knowledge and expertise in the Pega Customer Decision Hub with our comprehensive quiz. This quiz is designed for decisioning consultants and marketing professionals looking to enhance their understanding of customer engagement strategies.

With 97 challenging questions, you will learn about:

- Decision strategies

- Risk segmentation

- Engagement policies

- Next-Best-Action principles

1. U+ Bank’s marketing department currently promotes various home loan offers to qualified customers.

Customer contact limits

Suppression policy

Volume constraints

Applicability rules

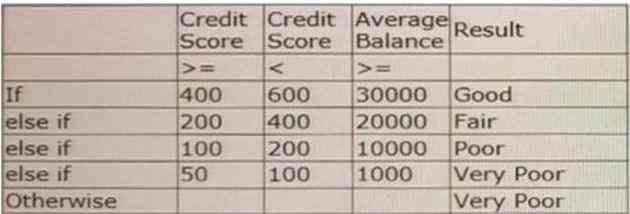

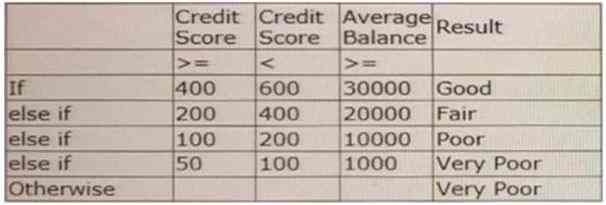

2. U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™

Which property allows you to use the risk segment computed by the decision table in the decision strategy?

PxOutcome

PxResult

PxSegmen

PxRiskSegment

3. U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table.

The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?

Add the risk segmentation rules in the Results tab of the scorecard rule

Add a decision table to a decision strategy and pass the credit score as the parameter

Add a decision table to a decision strategy and reference it in the scorecard component

Add three contact policies that correspond to the three risk segment

4. + Bank uses Pega Customer Decision Hub™ to display an offer to its customers on the U+ Bank website.

The bank wants to ensure that Silver credit cards are not offered to customers under 27 years of age. They also want to ensure that Platinum cards are offered only to customers who had a positive balance in the last year.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

Engagement policies

Contact policy rules

Customer segments

Arbitration rules

6. U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website. The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience. Select the correct suppression rule for the requirement:

If a customer is presented on the website with the same offer five times in the last 14 days, do not show the same offer to that customer for the next 10 days.

Suppress an action for 10 days if there are five impressions for any channel in the last 14 days

Suppress a group of actions for 10 days if there are five impressions for any channel in the last 10 days

Suppress an action for 10 days if there are five impressions for web channel in the last 14 days

Suppress an action for 14 days if there are five rejects for web channel in the last 10 days

7. MyCo, a telecom company, notices that when customers call to check on bill status, 80% of the time, they received the wrong offer promotion, leading to customer dissatisfaction. The company decides to boost customers’ needs in the prioritization formula, to improve sales in the current quarter.

Which arbitration factor do you configure to implement the requirement?

Context weighting

Propensity

Business weighting

Action value

8.Myco, a telecom company, uses Pega Customer Decision Hub™ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a decisioning consultant, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?

A list of customer email addresses from the Test Message tab

A seed list from the Test Message tab

Schedule an outbound run with a limited number of customers

Preview section from the email content editor

9.MyCo, a telecom company, introduced fiber optic service in the northern region of the country. They want to advertise this service on their website by using a banner and target the customers living in that area. What do you need to configure in the Next-Best-Action Designer to implement this requirement?

Applicability rules

Audience

Prioritization formula

Customer segment

10. As a decisioning consultant, you advise the board on the business issues for which they must use the Next-Best-Action strategy.

Which three business issues do you recommend? (Choose Three)

Resource Planning

Collections

Retention

Service

Accounting

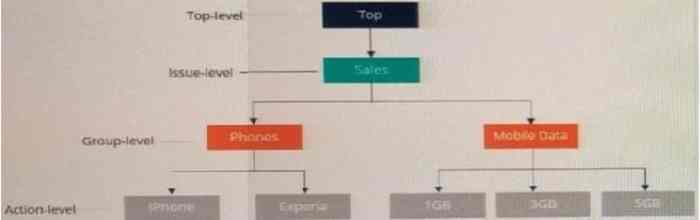

11. MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

Enable an engagement policy for the second group.

Set contact limits for both the groups

Map a real-time container to the Top-level or Issue-level.

Create a decision strategy at the Issue-level

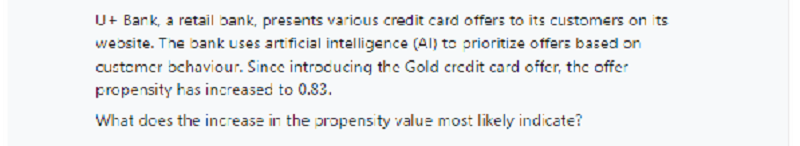

12. U+ Bank, a retail bank, presents various credit card offers to its customers on its website. The bank uses artificial intelligence (AI) to prioritize the offers based on customer behavior. Since introducing the Gold credit card offer, the offer click through rate propensity has increased to 0.83.

What does the increase in the propensity value most likely indicate?

Similar customers have ignored the offer.

Similar customers have shown interest in the offer

Similar customers have rejected the offer

Similar customers have purchased other offers

13. U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

Output template

Email treatment

File template

Dynamic template

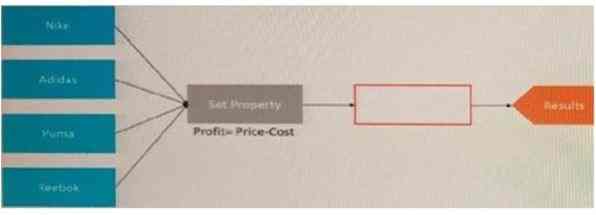

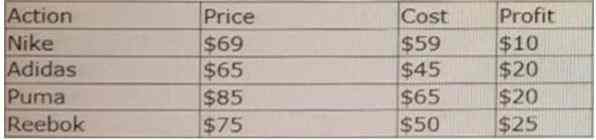

14.The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Price of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

9a

What is the number of outputs that each component has?

Set-Property=4, Results=4

Set-Property=1, Results=4

Set-Property=1, Results=

Set-Property=4, Results=1

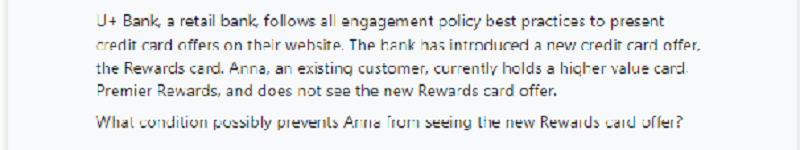

15. U+ Bank, a retail bank, follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card. Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

Eligibility

Suppression rules

Applicability

Suitability

16. To calculate the total number of customer responses of four actions in a group, you must use________________.

Four Set Property components

Four Group By components

One Group By component

One Set Property component

17. MyCo, a telecom company, wants to send promotional emails to give away phone accessories. The accessories can only be given away in batches of 50. When the stock in a batch is completed, a new batch can be promoted again.

You have decided to use volume constraint to limit the number of actions in a batch.

To meet the business requirement, what Reset Interval setting do you select?

When accessed

Manual

Daily

Reset Interval does not matter for this scenario

18. MyCo, a telecom company, wants to present their customers on Facebook with customer-centric mobile internet offers. What action must MyCo take to meet this business requirement?

Make a call

Place a paid ad

Create a Facebook post

Send an email

19. U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

19

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

Good

Poor

Very Poor

Fair

20. In Pega Customer Decision Hub™, the characteristics of an action are defined by using

Plain text

Properties

Banners

Logos

21. Aggregation components provide the ability to_________

Set a text value to a strategy property

Make calculations based upon a list of actions

Filter actions based on priority and relevance

Choose between actions

22. To access a property from an unconnected component, you see the____

Dot-property value directly

Component-dot-property construct

Property value

23. U+ Bank is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS. Which type of outbound interaction do you configure to implement this requirement?

Security event

Priority communication

Customer event

Scheduled update

24. U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. You have already created an action flow template with the desired flow pattern and reused it for all the credit card actions. What must you do to ensure that this action is not selected for any customers?

Set the action availability to Template

Set the action availability to Always

Set the action availability to Never

Set the action availability to Within a defined time period

25. A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

Volume constraints

Customer contact limits

Applicability rules

Suppression rules

26. To calculate the average margin of four propositions, you must use_____

Four Group By Components

Four Set Property components

One Set Property components

One Group By components

27. In a decision strategy, to use a customer property in an expression, you ________

Define the property as a strategy property

Prefix the property with the keyword Customer

Define Customer page in Pages & Classes

Prefix the property with the keyword Primary

28. In a next-best-action implementation project, to determine customer data requirements you must have the______

Proposition catalog

Business Issue and business group hierarchy

Strategy result class structure

Eligibility rules

29. You are the Decisioning Consultant on AI-powered one-to-one Customer Engagement implementation project. You are asked to design the Next-Best-Action prioritization expression that balances the customer needs with the business objectives. What factor do you consider in the prioritization expression?

Predicted customer behavior

Customer contact policy

Offer relevancy

Offer eligibility

30. U+ Bank, a retail bank, recently implemented a project in which mortgage offers are presented to qualified customers when the customers log in to the web self-service portal. As one of the offers is not performing well, the business wants to understand how many customers qualify for the offer. As a Decisioning Consultant, Which simulation do you run to check how many customers qualify for an action?

Pega Scenario Planner

Persona Testing

Audience simulation

Ethical Bias Check

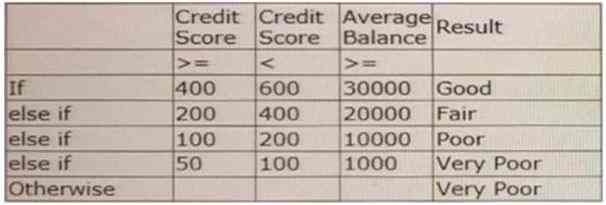

32.

Change the cutoff value in the results tab of the scorecard decision component

Change the cutoff value in the results tab of the scorecard model

Map the score value in the decision strategy to “<=200”.

Change in the strategy the condition from “.pxSegment <=175” to “.pxSegment<=200”

33. U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you turn to check if the conditions are too broad or narrow for your requirements?

Persona Testing

Ethical Bias Check

Pega Scenario Planner

Audience simulation

34. As a Decisioning Consultant, you have just implemented a project to present mortgage offers to customers on their self-service portals. The bank asks you to pull data on the distribution of the offers to well-engaged, under-engaged, or not-engaged customers. Which simulation do you run to get the required information?

Audience simulation

Pega Value Finder

Pega Scenario Planner

Distribution Test

35. What is the name of the property that is automatically recomputed for each decision component?

Priority

Propensity

Order

Rank

36. Myco, a telco, is working on implementing a project in which post-paid offers are presented to qualified customers. In the build stage of the ideation, the business wants to look for the new opportunities to improve marketing. As a Decisioning Consultant, which simulation do you run to meet the requirement?

Pega Value Finder

Audience Simulation

Distribution Test

Pega Scenario Planner

37. You are the decisioning consultant on an AI-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization that balances the customer needs with the business objectives. What factor do you consider in the prioritization expression?

Predicted customer behavior

Offer relevancy

Customer contact policy

Offer eligibility

38. Myco, a telecom company, introduced fibre optic service in the northern region of the country. They want to advertise this service on their website by using a banner and target the customers living in that area. What do you need to configure in the Next-Best-Action Designer to implement this requirement?

Applicability rules

Customer segment

Prioritization formula

Audience

39. U+ Bank, a retail bank, wants to include offer related images in the emails that they send to their qualified customers. As a decisioning consultant, what best practice must you follow to include images in the emails?

Attach images to the email

Provide links to images in the email

Host images on an external server

Embed images in the email directly

40. What does a dotted line from a “Group By” component to a “Filter” component mean?

To evaluate the “Group By” component , the “Filter” component is evaluated first.

A property from the “Group By” is referenced by the “Filter” component

Information from the “Group By” is copied over to the “Filter” component

There is a one-to-one relationship between the “Group By” and the “Filter” components

41. When a customer is offered an action that they already accepted, this is because____

The strategy uses interaction history to exclude previously accepted offers

There are no suppression rules defined

The actions are filtered based on eligibility

The customer intent was captured incorrectly

42.Myco, a telecom company, has recently implemented Pega Customer Decision Hub™. Now, the company wants to move away from traditional marketing and leverage the always-on outbound capabilities. What artifact do you configure to translate the traditional segments used to identify the target audience?

Engagement policies and Arbitration

Contact policies

Segmentation

Audience

43. To which types of decisions can Pega Customer Decision Hub™ be applied?

Determining how to retain a customer

Determining why response rates for a campaign in one region are below average

Determining how to optimize the product portfolio to increase market share

Determining the cause of a customer's problem

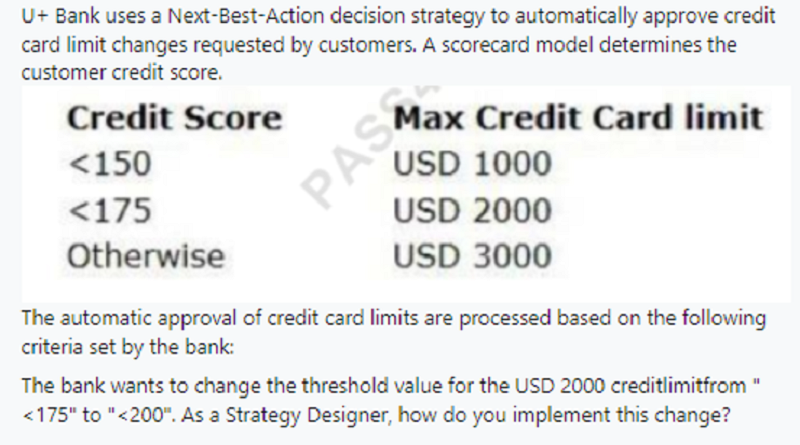

44. An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel.

75 emails 25 SMS

75 SMS and 25 emails

100

150

45. U+ Bank, a retail bank, has applied business weight to their credit card offers to manually nudge the offer. The bank analyzes the effect of the change in Scenario Planner. The following image shows the Projected reach and responses of the cards in the comparison mode. How many customers are likely to accept the Standard card?

115

21

14(21-7)

79(115-36

46. What does a solid arrow from a "Set Property" component to a "Filter" component mean?

There ia a one-to-one relationship between a "Set Property" and a "Filter" component.

A property from the "Set Property" component is referenced by the "Filter" component

To evaluate the "Set Property" component, the "Filter" component is evaluated first.

Information from the "Set Property" component is copied over to the "Filter" component .

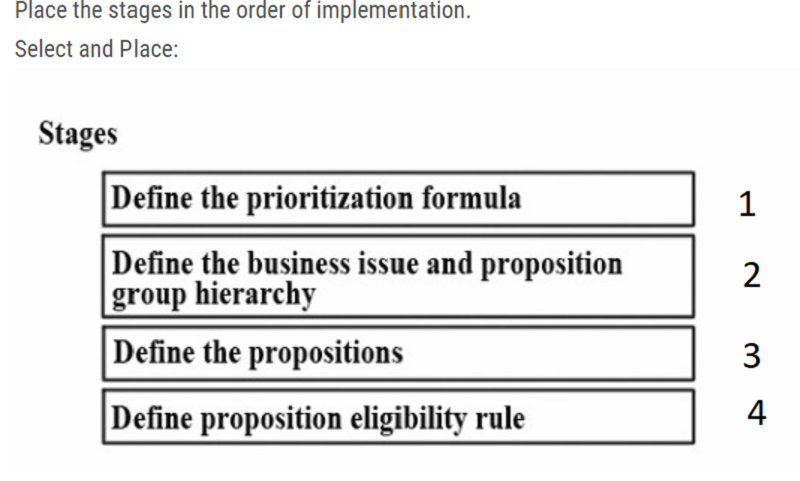

47.

2,3,4,1

1,4,2,3

1,2,3,4

4,3,2,1

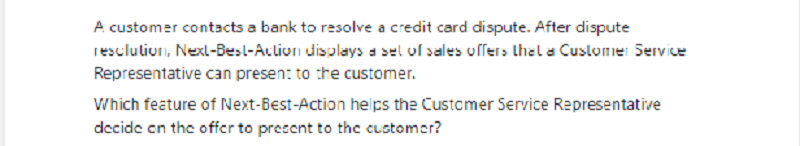

48.

Offers ranking

Interaction History

Call intent detection

Dispute handling strategy

49.

Similar customers have rejected the offer

Similar customers have purchased the offers.

Similar customers have ignored the offer

Similar customers have shown interest in the offer

50.

Eligibility

Suppression Rules

Applicability

Suitability

53.

Increase the starting propensity of the Platinum Plus card.

Increase the business weight of the Platinum Plus card

Increase the action value of the Platinum Plus card

Increase the context weight of the Platinum Plus card

54.

Only relevant action details and its treatment details

Only the image location

Only the action name and description

Only the image location and it's placement type

55.

Output template

Dynamic template

File template

Email treatment

56.

Select Refresh the audience.

Select different audience sample with similar profile

Run the starting ting population segment daily

Trigger an External ETL(Extract-Transform-Load) process

57.

Define the starting population

Map the real-time container to a business structure level

Enable the web channel

Add contact policy rules

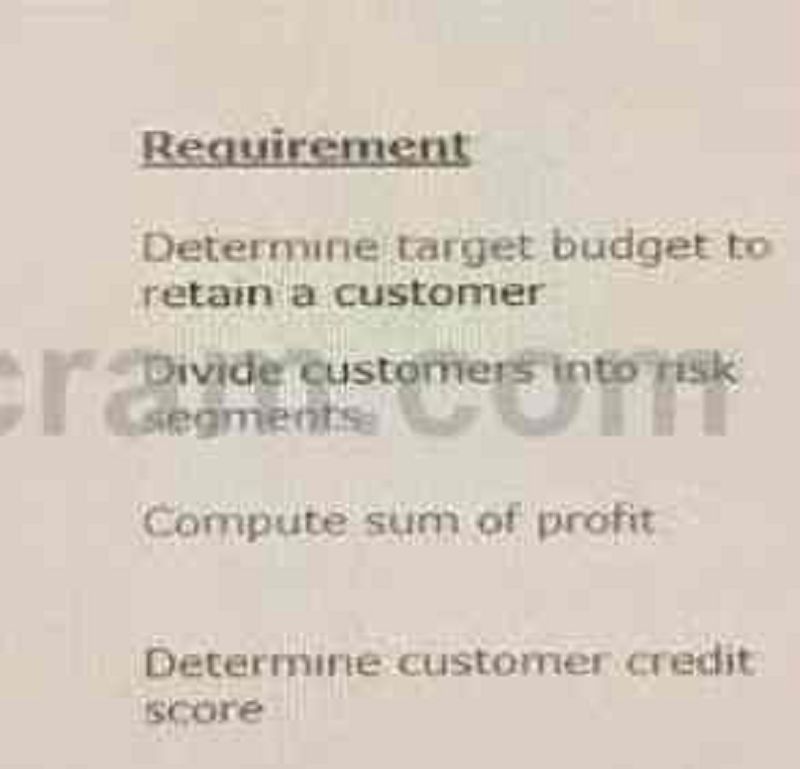

58. You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the left. Options: 1.Set Property , 2. Decision Table , 3. Group By, 4. Scorecard

1,2,3,4

1,4,2,3

2,3,1,4

3,1,2,4

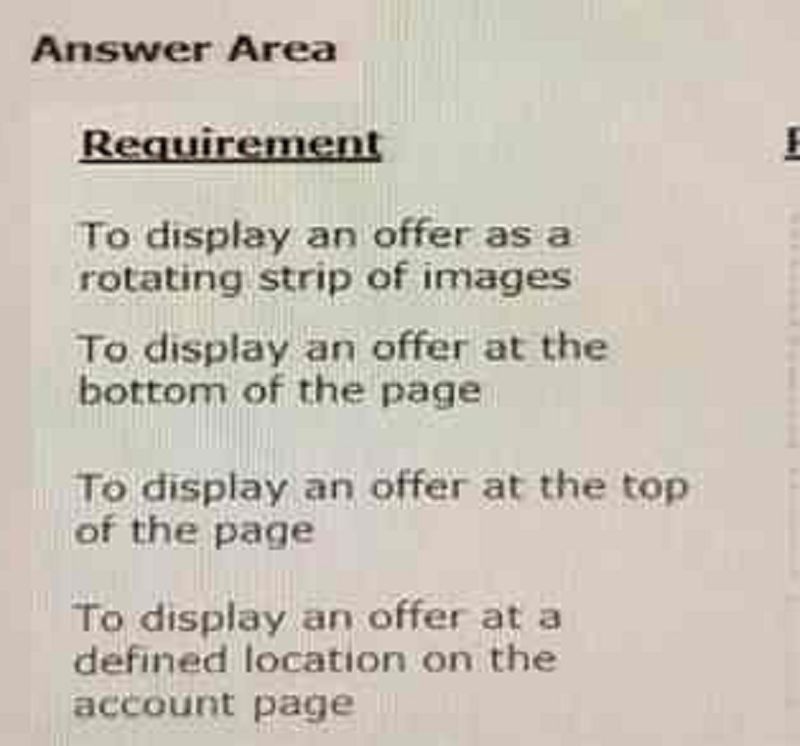

59. 21. U+ Bank has decided to use the Pega Customer Decision Hub™ to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

Hero

Tile

Carousel

Footer

U+ Bank, a retail bank, uses Pega Customer Decision Hub for their one-to-one customer engagement. The bank now wants to change its offer to consider both business objectives and customer needs. Which two factors do you configure in the Next-Best-Action Designer to implement this change? (Choose two)

Business levers

Engagement policies

Context weighting

Contact Policies

U+ Bank has launched a new credit card for all customers with a premium bank account. As a decisioning consultant, you need to create actions that involve the full life cycle: marketing, sales, and service. Which two valid actions do you create? (Choose Two)

Credit card status

No annual fee credit card

1% cash back credit card

Credit card number

U+ Bank, a retail bank, uses the always-on outbound approach to send outbound messages on different channels such as email, SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and channel integrations requirements. Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and instead write the selected customers and action details to a database table for later offline processing. What is the most efficient way to meet this requirement?

Set up a secondary schedule.

Bypass action flow processing

Bypass action flow processing

Add a new Send shape in all the action flows

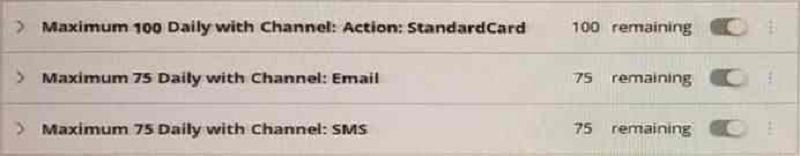

U+ bank's marketing currently promotes various credit card offers by sending emails to qualified customers. The bank wanys to limit the number of offers that customers can receive over a given period of time.

In the answer area, select the correct artifact ypu use to implement each requirement.

U+ bank's marketing currently promotes various credit card offers by sending emails to qualified customers. The bank wanys to limit the number of offers that customers can receive over a given period of time.

In the answer area, select the correct artifact ypu use to implement each requirement.

Do not send more than 500 email offers in the outbound run.

Do not send more than two email offers to a customer in one month.

Do not send any credit cards for ten days if a customer has clicked on a credit card five times in the last seven days.

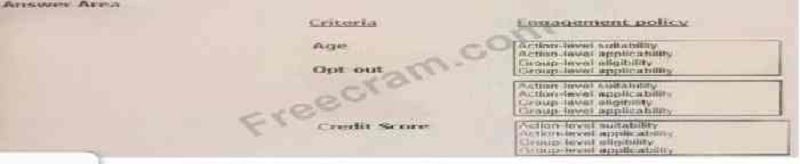

U+ Bank, a retail bank, has introduced a credit cards group with Gold Card and platinum card offers. The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicity opt-out of any dircet marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score> 500

As a decisioning consultant, how do you implement this requirement?

U+ Bank, a retail bank, has introduced a credit cards group with Gold Card and platinum card offers. The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicity opt-out of any dircet marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score> 500

As a decisioning consultant, how do you implement this requirement?

Age

Opt-out

Credit Score

Do not send a credit card for ten days if the card was shown three times in the last seven days.

As a Decisioning consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which statement is true when the simulation scope is:

Audience siulation with engagement policy arbitration?

The number of customers who receive an action more than once is displayed.

The number of times an action was presented to customer is displayed

The number of customers who receive more than one action is displayed

The number of customers who receive a particular action as the top action is displayed.

Free 4G upgrade

Retention

Tablets

Service

Change address

Proactive retention

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

Create a complex eligibility rule that uses a scorecard rule to determine the customer credit score.

Create a new tracking time period for 20 days

Enable a new channel

Use business levers to boost an offer.

Th customer must not be flagged as deceased

Customer already owns a higher-value offer

Must be a resident of the New york City

The savings product offers are only relevant if the customer has not explicity opted out of direct marketing

Inappropriate for customers with a credit score < 300 as they are likely to default

Assign a financial value to an action

Situational context for each action

Likelihood of a customer responding positively

Assert some level of control over the prioritization

Helps test the configuration of engagement policies with respect to an audience

Allows the business to engage more empathetically by identifying and profiling “ under served” , then suggesting actions for improvement

Enables you to simulate “What – if” scenarios so they can more accurately forecast results, optimize strategies, and explore potential tradeoffs.

Helps tests the engagement policies for unwanted discrimination

Outputs the results to a database table and presents the result using out-of -the box simulation reports.

{"name":"CDH Reviewer", "url":"https://www.quiz-maker.com/QPREVIEW","txt":"Test your knowledge and expertise in the Pega Customer Decision Hub with our comprehensive quiz. This quiz is designed for decisioning consultants and marketing professionals looking to enhance their understanding of customer engagement strategies.With 97 challenging questions, you will learn about:Decision strategiesRisk segmentationEngagement policiesNext-Best-Action principles","img":"https:/images/course7.png"}

More Quizzes

SFMC EEB101 - Lirik

10512

MB-200

351848

DB Cooper

10516

Joseph and His Coat

9414

One Direction Boyfriend - Who's Your Perfect Match?

201018817

Am I Famous - Do You Have Star Power?

201018346

Strengths Test - Free to Find Your Top Traits

201017697

Facial Muscle Labeling - Muscles of Facial Expression

201016629

Which Kuroko's Basketball Character Are You? Free

201018422

Amaurosis Fugax Medical Terminology - Midterm Prep

201022142

Pest Control Test Questions & Answers - Free

201018817

Solutes and Solvents Quick Check - Free Online

201015978